CONTENTS

01. OVERVIEW

EFD ICMS/IPI - Calculation of Reimbursement or Complement of ICMS Withheld by Tax Substitution or Advanced

By the publication of "COTEPE/ICMSAct No. 44/2018" and of "Digital Tax Bookkeeping Practical Guide - EFD-ICMS/IPI", from version 3.0.2 onwards, new records of "Complementary Information about outflow operations of goods subject to tax substitution" were instituted, for the purpose of calculating the complement or reimbursement of ICMS withheld by tax substitution (ICMS-ST), or paid in advance:

Record | Description |

C180 | Complementary information about inflow operations of goods subject to tax substitution (code 01, 1B, 04 and 55) |

C186 | Complementary information about inflow return operations of goods subject to tax substitution (code 01, 1B, 04 and 55). |

C185 | Complementary information about outflow operations of goods subject to tax substitution (code 01, 1B, 04 and 55) |

C186 | Complementary information about inflow return operations of goods subject to tax substitution (code 01, 1B, 04 and 55). |

C330 | Complementary information about outflow operations of goods subject to tax substitution (code 02) |

C380 | Complementary information about outflow operations of goods subject to tax substitution (code 02) |

C430 | Complementary information about outflow operations of goods subject to tax substitution (code 02, 2D and 60) |

C480 | Complementary information about outflow operations of goods subject to tax substitution (code 02, 2D and 60) |

C810 | Electronic tax receipt document items – SAT (CF-E-SAT) (code 59) |

C815 | Complementary information about outflow operations of goods subject to tax substitution (CF-E-SAT) (code 59) |

C870 | Electronic tax receipt document items – SAT (CF-E-SAT) (code 59) |

C880 | Complementary information about outflow operations of goods subject to tax substitution (CF-E-SAT) (code 59) |

H030 | Complementary information of inventory of goods subject to the tax substitution system |

1250 | Consolidated information about ICMS complementation, reimbursement and restitution balances |

1255 | Consolidated information about ICMS complementation, reimbursement and restitution balances by reason |

TOTVS presents, for the Microsiga Protheus product line, the routine ICMS-ST Complement and Reimbursement Calculation (FISA302). It was developed using tax regulation premises and, besides generating data to be displayed in the new EFD ICMS/IPI records, the routine presents the estimated calculated values of the tax to be reimbursed and/or complemented, for checking purposes. It also offers resources to check the values in accordance with calculation estimates by the system.

02. IMPLEMENTATION PROCEDURE

Data Dictionary and Update Package

IMPORTANT

For releases previous to 12.1.27, besides applying the patch, you must run the compatibility application UPDDISTR with the available data dictionary differential.

The file with the differential data dictionary compatible with versions 12.1.23, 12.1.25, 12.1.27 is available through Continuous Dispatch and you may access it through the links offered in the document Update Packages - Tax Management.

For information about Continuous Dispatch: http://tdn.totvs.com/x/H4uCEw.

For information about the UPDDISTR compatibility tool, access: Dictionary and database updater - UPDDISTR.

Adding a new routine to the menu

1. In Configurator (SIGACFG), access Environments/Register/Menu (CFGX013). Enter the new menu option according to the following instructions:

Menu | SIGAFIS |

Sub-menu | Miscellaneous |

Routine Name | EFD/ICMS/IPI Reimbursement Calculation |

Program | FISA302 |

Module | Tax Records |

Type | Protheus |

03. PROCEDURE

Attention

The calculation routine was developed in accordance with the DIGITAL TAX BOOKKEEPING PRACTICAL GUIDE – EFD ICMS/IPI and its execution is required to generate new Tax SPED records.

After processing, the routine displays the estimated tax values to be reimbursed and complemented in the period analyzed. However, this is a support routine, given that in the Digital Bookkeeping Practical Guide - EFD ICMS/IPI, the composition rules and fields for tax complement and reimbursement values are sometimes not specified, leaving it up to the specific laws of each state, as you can see, for example, in the description of record C185:

You can access this routine through the name FISA302 or through the menu of module Tax Records, in Miscellaneous / Calculations.

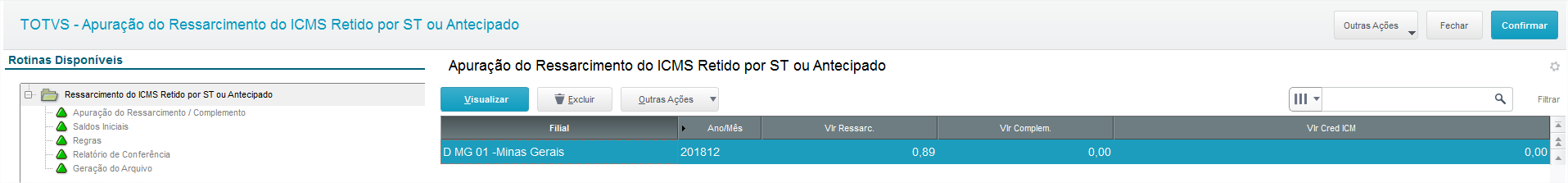

When you access the routine, the main process screen appears. The menu located on the left lists the routines related to the calculation and generation of the file in question, detailed later, and, on the right side, the calculations already made are listed:

Click View to display the results of the calculation selected. On this screen, besides the calculated totals, you can view the calculated result for each calculation rule (related to code table 5.7 available per each state) and, for each rule, the transaction that composed the value calculated for reimbursement or complement, entered in inflow averages used to obtain the values.

Click Delete to delete the calculation selected. Be mindful that the ending balances of the period are also deleted:

Initial Balances

Attention!

In accordance with the DIGITAL TAX BOOKKEEPING PRACTICAL GUIDE – EFD ICMS/IPI, the following records have been instituted:

RECORD H005: INVENTORY TOTAL

Field 06 To control goods subject to the tax substitution system – restitution /reimbursement/ complementation – presented in accordance with law defined by the home state of the taxpayer.

Validation: The file that presents at least one record C180, C185, C330, C380, C430, C480, C815 or C870 must have, at least, one record H005 with “MOT_INV” = 06 and with field “DT_INV” equal to the day immediately before field “DT_INI” entered in record 0000

RECORD H010: INVENTORY.

From January 2020 onwards, all items stated in records C180, C185, C330, C380, C430, C480, C815 and C870 must have at least one record H010, under a record H005 with field 04 “MOT_INV” = “06” (control of goods subject to the tax substitution system – restitution/ reimbursement/ complementation). This rule does not apply when field 03 (VL_INV) of record H005 is equal to “0” (zero).

RECORD H030: COMPLEMENTARY INFORMATION OF INVENTORY OF GOODS SUBJECT TO THE TAX SUBSTITUTION SYSTEM.

This record is required when field MOT_INV of record H005 is equal to "06", in accordance with laws defined by the home state of the taxpayer. Do not enter it for other reasons.

These records, for the new reason of inventory '06', must refer to the date immediately before the start of the period in which EFD ICMS/IPI is being presented. Example: When sending Tax SPED related to January/2021, the record H005 and children necessarily refer to 12/31/2020 and contain the quantities and initial averages for the calculation of values to be reimbursed and complemented for the current period.

The values for composing these records, in reason for inventory '06', are obtained through table CIL (ICMSST Res. Periodic Balances) and also of Inventory Record (generally obtained through report Inventory Model P7 - MATR460), as already traditionally done for other Block H presentation reasons.

For further information, refer to:

- Stock Closing: PEST05502 - MATA280 - Script to perform the stock balance carry forward;

- Inventory and Block H: How to generate Block H of the Tax Sped;

Important

Initial Balances

For the correct operation of the routine, the taxpayer must elect a period for the start of the calculation of ICMS-ST Complement/Reimbursement in the form of the EFD-ICMS/IPI Practical Guide (routine FISA302). From this point on, a stock/inventory closing must be executed on the day immediately before the new period. Example: The taxpayer chooses to start calculating via FISA302 in January/2021. In this case, there must necessarily be an inventory closing dated 12/31/2020. Henceforth, the loading of Initial Balances must be executed for the routine. This is a starting point for the calculation. Such loading may be executed automatically or manually.

For automatic loading, the routine uses the result of report MATR460 (using option Export to Tax SPED) and, for each product found in it, it composes the initial averages (ICMS OP, ICMS ST and ICMS ST Calculation Base), starting from the most recent inflow transaction, until composing the quantity found in inventory.

For the manual load, enter the inventory quantity for each product and the aforementioned averages, which you can manually calculate from the incoming invoices that composed such quantity.

If neither the automatic load (CIL_TPREG = 1) nor the manual load (CIL_TPREG = 2) are executed, the routine starts from the initial balances set to zero, which may subsequently compromise the entire calculation. Therefore, the process of loading initial balances is of the utmost importance for calculating the reimbursement and must be executed only once, in the period in which you start using the routine, basing it on the inventory of the day immediately before it. Henceforth, the routine controls the balances automatically, because the final balance of a period becomes the initial balance of the next period.

NOTE: Only products with field ICMS 271 (B1_CRICMS) set to "1 - Yes" may be registered in the Initial Balances routine and, consequently, only these products are used for performing the calculation.

Incoming Tax Booking

In short, when the substituted taxpayer acquires directly from the tax replacement, the tax document that covers this operation generally has a CST 10 and also has calculation of Own ICMS and ICMS-ST. Upon entering this document in table SFT, the following fields are filled out: FT_BASERET, FT_ALIQSOL and FT_ICMSRET. If the substituted taxpayer acquires from another substituted, generally the incoming tax document will have a CST 60 and no ICMS calculation, neither Own nor ST. Thus, you need to manually enter the value of ICMS-ST in fields D1_BASNDES (B.ICMS ST An), D1_ALQNDES (A.ICMS ST An) and D1_ICMNDES (ICMS ST Ante) while entering the tax document, because these fields feed the fields of table SFT: FT_BASNDES, FT_ALQNDES and FT_ICMNDES. The following is necessary: Or FT_BASERET / FT_ICMSRET (purchase from substitute) or FT_BASNDES / FT_ICMNDES (purchase from substitute) be filled out, otherwise the inflow average is not calculated or is incorrectly calculated, compromising the reimbursement calculation

Important!

For further information on the calculation rules used in the reimbursement/complement calculation, refer to the following documentation:

RESICMSST - Calculation performed by calculating the reimbursement/complement of ICMS ST (FISA302)

Load Periodic Balances (automatic load)

This is an enabling routine, the use of which is directly connected to stock closings of the period immediately before the one in which the reimbursement is entered in the system. As mentioned above, the quantity of each product found in the inventory on the date desired is captured and the routine processes the previous inflows to compose the averages for each product, creating a record in table CIL with the quantity and initial averages calculated, and field CIL_TPREG filled out with the value '1'.

Manual Load

If you cannot execute the process above for any reason, you can still load each product manually. In this case, you must enter the quantity found in inventory and the initial averages that you may calculate manually from the incoming invoices that composed such quantity, given that field CIL_TPREG is filled out with the value '2'.

Field Descriptions

Product – Code of the product

Initial Qty – Initial quantity of the product

Final Qty – Final quantity of the product

Record Type

- Initial Balance - Automatic = Records automatically generated by option Load Periodic Balances (automatic load).

- Initial Balance - Manual = Records manually registered. Only this option allows editing values.

- Calculation Balance = Records automatically generated by performing the Calculation for the next period.

Total Initial Value of Own ICMS – Enter the initial value of Own ICMS for the period

Total Final Value of Own ICMS – Final value of Own ICMS for the period, arrived at by calculation

Initial Unit Value of Own ICMS – Enter the average initial unit value of Own ICMS for the period

Final Unit Value of Own ICMS – Average final unit value of Own ICMS, arrived at by calculation

Total Initial Value of ICMS ST – Enter the initial value of ICMS ST for the period

Total Final Value of ICMS ST – Final value of ICMS ST for the period, arrived at by calculation

Initial Unit Value of ICMS ST – Enter the average initial unit value of ICMS ST for the period

Final Unit Value of ICMS ST – Average final unit value of ICMS ST, arrived at by calculation

Total Initial Value of FECP – Enter the initial value of FECP ST for the period

Total Final Value of FECP – Final value of FECP ST for the period, arrived at by calculation

Initial Unit Value of FECP – Enter the average initial unit value of FECP ST for the period

Final Unit Value of FECP – Average final unit value of FECP ST, arrived at by calculation

Total Initial Value of ICMS ST CB – Enter the initial value of ICMS ST Calculation Base for the period

Total Final Value of ICMS ST CB – Final value of ICMS ST Calculation Base for the period, arrived at by calculation

Initial Unit Value of ICMS ST CB – Enter the average initial unit value of ICMS ST Calculation Base for the period

Final Unit Value of ICMS ST CB – Average final unit value of ICMS ST Calculation Base, arrived at by calculation

Deleting in Batches

This option deletes, for all products, the initial load balances (records with field Record Tp filled out with options Initial Balance - Automatic and, alternatively, Initial Balance - Manual), in the period entered.

Rules

The processing of the calculation analyzes inflow and outflow transactions in the period selected, for calculating values to be reimbursed and complemented, besides updating stock balances for each product moved. The definition of which transactions to calculate or not is a combination of CFOP (Tax Code of Operations and Provisions) with CST (Tax Status Code) of each transaction.

Attention!

Therefore, the purpose of this routine is to grant the user control over transactions that must be taken to the calculation or not, through the configuration of CFOPs and its CSTs. When you first access the routine, a default automatic load of this definition is executed.

Example of register: Indicate that tax transactions with CFOP 5102 and with any CST listed on the grid are used in the calculation process.

Fields:

CFOP - Enter the CFOP that must be used in the processing of the Calculation routine.

Taxable Event Not Performed - Enter whether outflow transactions with this CFOP are classified as Deemed Taxable Event Not Performed.

CST - Enter the CSTs that, along with the CFOP registered above, must be used in the calculation process.

Important!

Example: CFOP 1.556 - Acquisition of Material for use or consumption.

Attention!

DT PE FSA302FMOV - Edit filter in Query that returns transactions for Reimbursement calculation - FISA302

Important!

For further information on the calculation rules used in the reimbursement/complement calculation, refer to the following documentation:

RESCMSST - Calculation performed by calculating the reimbursement/complement of ICMS ST (FISA302)

Load

Calculation of Reimbursement / Complement

The routine Calculation of Reimbursement or Complement of ICMS Withheld by Tax Substitution or Advanced, from the initial balances of each product (Initial Balances Register), processes the operations of the period by adopting the weighted moving average cost method, always following Rules Register definitions.

Each transaction is chronologically booked in a single line. Every day, all inflow transactions are calculated, followed by the returns of purchases and sales, and finally, outflow transactions in accordance with legal provisions. The only exception to this chronology is due to return operations that occur on the same day of their original operation, because the returns must annul the effects of the original operation and you can only identify the values to be reimbursed or complemented of an operation after their processing.

Regarding the order of transactions in the same day, inflow transactions and any returns are analyzed before outflow transactions. All calculated transactions update the physical and financial balance of the product. Regarding reimbursement/complement, outflow transactions may or may not generate tax complement or reimbursement.

At the end of processing, the routine presents, for the period analyzed, the estimated tax values to be reimbursed or complemented, besides transferring the calculated final balance of each product to the initial balance of the following period.

Enter the period for processing:

If you enter a period already previously processed, the question below is displayed. If you confirm the reprocessing, the existing records of the period entered are deleted and reprocessed.

Important

Main screen with the result of the calculation process:

View

You can check the calculation result by legal framework:

Delete

Deletes all calculation records in the period selected.

Checking Report

For purposes of checking calculated values, you can extract a detailed report, as a spreadsheet, of each product transaction in the period selected.

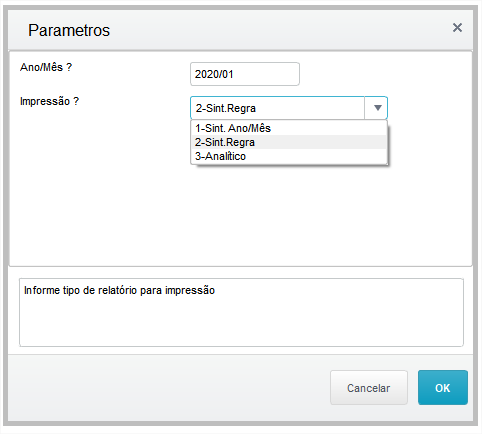

Parameters for report generation:

From Year/Month - Enter the Reference Year/Month for selecting records.

Transaction - Printing

1 - Summ. Year/Month - Display summarized report

2 - Summ. Rule - Display summarized report and also display the framework and rule in use.

3 - Detailed - Display detailed report.

Creating the ST Restitution File

After calculating the Reimbursement, you can create the .TXT file.

Locate the ST MG Restitution option, created below the new File Creation structure, and fill out parameters as requested.

Parameters for generation

- Calculation Year/Month - Enter the calculation period. Ex: 2021/02

- File Purpose Code - Enter the Purpose in accordance with the application offered by SEF MG.

- Framework Code - In accordance with Table 5.7 - Code of Reasons for ICMS ST Complementation and Restitution.

- Create File - Enables file creation in Consolidated or Detailed form.

- Target File Directory - Enter the location in which to save the files created by this routine.

- Target File Name - Enter the name of the file to be created.

File Purpose

During the file creation process, a progress screen is displayed as shown below

At the end of file creation, an information screen is displayed with the process status, which may indicate the file was successfully created or not created.

Example of file with layout of purpose 4.

Example of file with layout of purpose 5.

04. FAQ