Content

Objective

This module allows the management of a company's financial events and resources considering the control of the following processes:

- Financial planning of operations through budgets.

- Monitoring of events that result in the entry or disbursement of funds through the use of cash flow, in this way, the manager acquires information in real time that helps them in their decisions about cash availability.

- Transparency in operations, through data accounting.

- Control of bills and values as well as of customers and suppliers.

- Management of records of bills payable and receivable.

- Bank communication.

- Control of bills receivable.

- Advances.

- Provisional bills.

- Budgetary control by class in up to 5 different currencies.

- Investment control.

- Financial agreement control.

- Ease and speed in dealings between the company and the bank.

- Automatic bordereau.

Bank instructions

- Banking communication (CNAB standard): Company to Bank and vice-versa.

- Bank balances.

- Issue of statements.

- Bank reconciliation.

- Bank bills.

- CNAB checking reports.

- Commission control.

- Commissions by issue of bills.

- Commissions by posting bills (with different percentages).

- Monitoring of customer history.

- Highest balance due.

- Average arrears period.

- Maximum arrears period.

- Bills protested.

- Payments made.

- Current Account Ledger.

- Control of customer balance: overdue, falling due, orders without credit and orders with credit.

- Control of balances receivable: total amount overdue, total amount falling due, number of outstanding bills and number of overdue bills.

- Auxiliary journal.

- Collection summary.

- Accounting of transactions: online or offline.

- Financial projection in 4 currencies: by reference (in days), by the inflation trend and availability control (by cash).

Buyer

It is a financing agreement for payment of inputs or services purchased by the customer from their suppliers. It is aimed at companies that seek to buy in cash from their suppliers, however, with a longer term and better rates, as well as negotiating payment with the bank under conditions appropriate to their cash flow.

Guarantees: trade notes, checks, collateral and debtor liable.

Advantages for the buyer/borrower:

- Enables the replacement of supplier financing for banking financing when the bank offers more attractive interest rates.

- Possibility of negotiating with the seller the benefits they obtain; similar to those of the seller.

- Flexibility for cash flow planning.

- Improved operational results: reduced interest at purchase price.

- Competitive Advantage compared to its players that do not use the product.

Vendor

It is a sales financing agreement based on credit assignment, which allows a company to sell its product in installments to legal entities and receive in cash.

The Vendor assumes the buyer company is a regular customer of the seller, since the seller takes the risk of the business with the bank.

Possibility of using electronic means to contract operations.

Guarantees: Supplier and seller guarantee.

Advantages for the supplier/seller:

- Cash advance: payment up front.

- Tax charge reduction, as sales are effected in cash.

- More flexible financing terms.

- Interest Rate Flexibility

- More competition and better financial efficiency.

- Longer payment term for the purchaser.

- Faster turnover of goods.

| Accounts Payable |

|---|

Control of bills payable. Budget control by class, in up to 5 different currencies. Posting of bills payable

Ease and speed in dealings between the company and the bank:

Follow-up of Supplier history:

Control of balance payable:

Accounting of transactions: on-line and off-line. Control of company cash (balance). |

| Accounts Receivable |

|---|

Includes the following criteria: Control of bills receivable. Advances. Provisional bills. Budget control by class, in up to 5 different currencies Investment control Financial agreement control. Ease and speed in dealings between the company and the bank: Automatic bordereau. Bank instructions Banking communication (CNAB standard):

Bank balances. Issue of statements. Bank reconciliation. Bank bills. CNAB checking reports. Commission Control:

Monitoring of customer history:

Control of customer balance:

Control of balances receivable:

Financial projection in 4 currencies:

|

| Cash Flow |

|---|

|

It is a very efficient management tool that includes the set of income and disbursements of financial resources by the company in a given period. The analysis and control of information facilitates decision making according to the following criteria:

Note Petty Cash It allows the control of the amounts available for immediate and small expenses in order to manage the flow of money in and out in an agile, simple and less bureaucratic way. This control is made according to the following options:

APV - Adjustment at Present Value The AVP makes the adjustment to demonstrate the present value of a future cash flow that may be represented by inflows or outflows of funds (or an equivalent amount; for example, credits that decrease future outflows would be equivalent to inflows of funds). To determine the present value of cash flow, the following information is required: value of the future flow (considering all terms and conditions of the contract), date of the financial flow, and discount rate applicable to the transaction. To make the determination of CPC 12 (Accounting Pronouncements Committee) feasible, the Financial module has the following features:

The following routines comprise the process of APV calculation:

|

| Bank Balance in Multiple Currencies |

|---|

This resource controls checking accounts in currencies other than the current one (BRL). Thus, if the company has checking accounts abroad, transactions can be controlled in other currencies (for example: USD, EUR). To use this functionality, it is necessary to register the information in the Banks routine and fill in the Currency field, consequently, the bank balance in multiple currencies is enabled to be used in the following routines:

|

The Microsiga Protheus® system has the bookkeeping feature for the Financial module that allows the exchange of standardized and pre-established information by Banks through electronic files. This process guarantees more reliability, speed in data processing and elimination of manual controls.

CNAB (National Council for Bank Automation) establishes the rules to format files through specific guidelines.

First, the system administrator must configure the remittance and return files for the bills in the Configurator module:

| Model 1 | Remittance | Return | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CNAB Receivable | In the Configurator module, access the CNAB Receivable option, and configure the remittance file of Accounts Receivable according to the provisions and rules described in the Bank guideline. In the Financial module, access the Bank Parameters option and register the information. Note: In the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the bank. The system default is Table 17 of the Configurator environment. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters Register). If it is Table 17, check the bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. |

In the Configurator module, access the CNAB Receivable option and set the return file of Accounts Receivable according to the provisions and rules described in the Bank guideline. The system generates a standard layout of the return file while adding this routine. The file rows must not be changed. You only need to enter the columns of Initial and Final Positions. In the Financial module, access the Bank Parameters option and register the information. Note: In the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the Bank. The system default is Table 17 of the Configurator environment. However, it is possible to generate new tables to perform the same treatment. If the Bank Parameter register is already configured, you do not have to add a record again, except if you need to work with two tables of type identification in the system, send/receive. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters Register). If it is Table 17, check the bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, access the CNAB Occurrences option and register the Bank occurrences for the return of Accounts Receivable. Accounting of posts of accounts receivable uses the standard entry from 521 to 526 for posting, 527 for cancellation, and 562 for bank expenses accounting. In the Financial module, access the CNAB Return Report option and check whether bills are received correctly, because a list of divergences between the bank return text file and the system bill file is displayed in it. In the Financial module, access the CNAB Receivable Return option and receive the bank return text file, according to the parameters defined. |

||||||||

| CNAB Payable | In the Configurator module, access the CNAB Payable option and configure the return file of Accounts Payable according to the provisions and rules described in the Bank guideline. In the Financial module, access the Bank Parameters option and register the information. Note: in the E5_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the Bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. You do not need to register occurrence for Submission of CNAB Payable. In the Financial module, access the Bordereau option and generate the payment bordereaux with the bills to be sent to the Bank. In the Financial module, access the Generate File Payable option and generate the text file to be sent to the Bank. |

In the Configurator module, access the CNAB Payable option and configure the return file of Accounts Payable according to the provisions and rules described in the Bank guideline. The system generates a standard layout of the return file while adding this routine. The file rows must not be changed. You only need to enter the columns of Initial and Final Positions. In the Financial module, access the Bank Parameters option and register the information. Note: in the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the Bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. If the Bank Parameter register is already configured, you do not have to add a record again, except if you need to work with two tables of type identification in the system, send/receive. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills the Bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, access the CNAB Occurrences option and register the Bank occurrences for the return of Accounts Receivable. Accounting of posting accounts payable uses the standard entry 530 for Posting and 531 for Cancellation. In the Financial module, access the CNAB Return Report option and check whether bills are received correctly, because a list of divergences between the bank return text file and the system bill file is displayed in it. In the Financial module, access the CNAB Receivable Return option and receive the bank return text file, according to the parameters defined. |

| Model 2 | Remittance | Return | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CNAB Receivable | In the Configurator module, access the CNAB Model 2 option and configure the remittance file. In the Financial module, access the Bank Parameters option and register the information. Note: In the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, go to the CNAB Occurrences option and register the Bank occurrences to submit Accounts Receivable. In the Financial module, access the Bordereau option and generate the bordereaux with the bills to be sent to the Bank. In the Financial module, access the Generate File Receivable option and generate the text file to be sent to the Bank. |

In the Configurator module, access the CNAB Model 2 option and configure the return file. In the Financial module, access the Bank Parameters option and register the information. Note: In the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the Bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the Bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, access the CNAB Occurrences option, register the Bank occurrences for the return of Accounts Receivable. Accounting of posts of accounts receivable uses the standard entry from 521 to 526 for posting, 527 for cancellation, and 562 for bank expenses accounting. In the Financial module, access the CNAB Return Report option and check whether bills are received correctly, because a list of divergences between the bank return text file and the system bill file is displayed in it. In the Financial module, access the CNAB Receivable Return option and receive the bank return text file, according to the parameters defined. |

||||||||

| CNAB Payable | In the Configurator module, access the CNAB Model 2 option and configure the remittance file. In the Financial module, access the Bank Parameters option and register the information. Note: in the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the Bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the Bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, access the Payment Bordereau option and generate the bordereaux with the bills to be sent to the Bank. In the Financial module, access the Generate File Payable option and generate the text file to be sent to the Bank. |

In the Configurator module, access the CNAB Model 2 option and configure the return file. In the Financial module, access the Bank Parameters option and register the information. Note: In the EE_Tabela field, enter the code of the relationship table between the bill type in Financial and the bill type in the Bank. The system default is Table 17 of the Configurator module. However, it is possible to generate new tables to perform the same treatment. In the Configurator module, access the Tables option and check which table is used for this Bank (through the Bank Parameters register). If it is Table 17, check the Bank return standard regarding the bill type and update the table in the Configurator module. Example: Considering that, for NF type bills, the bank identifies as 01, Table 17 is as follows:

Thus, the System identifies the NF type bills of the System as equivalent to the bills that the bank identifies as 01. In the Financial module, go to the CNAB Occurrences option and register the Bank occurrences to submit Accounts Receivable. Accounting of posting accounts payable uses the standard entry 530 for Posting and 531 for Cancellation. In the Financial module, access the CNAB Return Report option and check whether bills are received correctly, because a list of divergences between the bank return text file and the system bill file is displayed in it. In the Financial module, access the CNAB Receivable Return option and receive the bank return text file, according to the parameters defined. |

It is the payment of an invested or loaned capital or, even, the ‘rent’ that is paid or charged for the use of the money. It is also the difference between the amount redeemed in a financial investment and its initial value.

In any monetarist economy, the cost of lending or borrowing any amount must be measured by means of an index between the price of this credit and its value over a given period of time. This is called the interest rate, which, in turn, is used as a measure to assess both the rate of return on capital from those who have resources and those who do not (loan). In the first case, it is necessary to consider the risk factors, expenses, inflation and a gain one hopes to obtain when applying that rate (so, the higher the better). For the other context, the lower the better.

Amount is the term used to classify the initial capital added to the interest of the period.

| Simple Interest |

|---|

It occurs when the interest rate always affects the initial capital. The rate, therefore, is called proportional, since it varies linearly over time. In this case, 1% per day reaches 30% per month, which represents 360% per year and so on. Consider the initial capital P applied at simple interest of rate i per period, for n periods. Take into account that simple interest refers to initial capital, so we have the following formula: J = P*i*n J = Interest after nperiods of capital P applied at an interest rate per period equal to i. At the end of n periods, it is clear that the capital is equal to the initial capital added to the interest earned in the period. The initial capital added to interest from the period is called amount (M). Therefore, the formula would be represented as follows: M = P + J J = P + P * i * n M = P + P * i * n So, M = P(1 + i * n) Example: In the amount of $3,000.00, an interest rate of 5% is applied every month, for five years. Calculate the amount and interest by the end of the period. P = 3,000.00, i = 5% = 5/100 = 0.05 and n = 5 years = 5,12 = 60 months. J = 3,000.00 * 0.05 * 60 = 9,000.00. M = 3000(1 + 0.05*60) = 3,000(1+3) = 12,000.00. |

| Compound Interest |

|---|

Occurs when the interest rate is levied on the initial capital, plus accrued interest up to the previous period. The rate varies exponentially over time and, in this case, 1% per day is not equal to 30% per month, which in turn, will not be 360% per year. The use of compound interest is very common in the financial system and, therefore, more useful for calculating everyday problems. The interest generated for each period is added to the main to calculate interest for the following period. Capitalization is when interest is incorporated into the main, so, after three months of capitalization, for example, it is possible to notice the following scenario: First month: M =P.(1 + i) Second month: the main is equivalent to the previous month: M = P x (1 + i) x (1 + i). Third month: the main is equivalent to the previous month: M = P x (1 + i) x (1 + i) x (1 + i). This context results in the formula: M = P(1 + i)n The rate i must be expressed in the same time measurement of n, which means that both must be in the same unit, that is, interest rate per year for n years. In the system, the rate entered is processed as annual rate. Thus, n must be converted into years, that is, 1 month is equal to 1/12 or 30/360, so time is in the same unit as the interest rate. To calculate interest, decrease the main from the amount at the end of the period: J = M – P

Example: In the amount of $6,000.00, an interest rate of 3.5% is applied every month, for one year. P = BRL 6,000.00 n = 1 year = 12 months i = 3.5 % per month = 0.035 M = ? Applying the formula: M = P (1 + i) n M = 6,000 (1 + 0.035)12 M = 6,000 x 1.511 = 9,066.41 |

| Relation between interest and progression | ||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

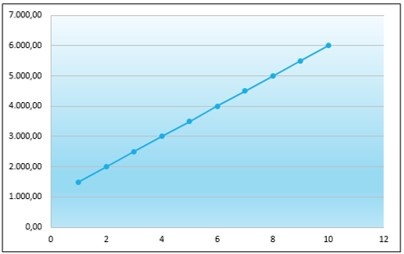

In capitalization of simple interest, balance grows in arithmetic progression. In capitalization of compound interest, balance grows in geometric progression. Consider the initial balance of $1,000.00 and an interest rate of 50% in the period. Simple interest:

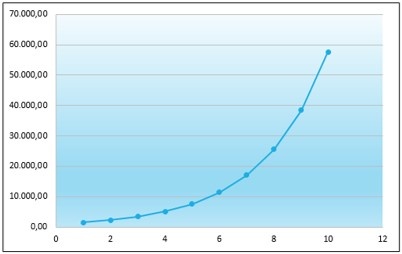

Compound interest:

When calculating compound interest, as it is a geometric progression, interest is charged on interest and it is not possible to divide an annual rate to obtain the daily rate. In this case, use the equivalent rate: i q = (1 + i t)q/t-1 i q = rate for the intended period. i t = rate for the given period. q = intended period. t = given period. p.a. = per annum p.d. = per day. Example: 9.7% p.a. equivalent to: i q = (1 + 0.097) 1/360 - 1 = 0.000257197 iq= 0.02572% (with 5 significant digits) which means: 9.7% p.a. equivalent to 0.02572% per day

For compound interest: FV= Future Value PV = Current Value I = Rate (*) n = Period (*) Note (*) both variables must be in the same time period. So: FV = 14,500 (1 + 0.097) 1/360 = 14,503.73 J = 14,503.73 – 14,500.00 = 3.73 Note: 1/360 = 1day in one year. Or using the daily equivalent rate: FV = 14,500 (1 + 0.000257197) 1 = 14,503.73 J = 14,503.73 – 14,500.00 = 3.73 |

Note

The calculation of interest for bills receivable (which have not yet been paid) is performed according to the parameter MV_JURTIPOS and to the following criteria:

Simple Interest (parameter MV_JURTIPOS = S)

Interest = Bill balance * (1 + (days overdue * (interest rate / 100)))

Compound Interest (parameter MV_JURTIPOS = C)

Interest = Bill balance * ((1 + (interest rate / 100)) * (days overdue)

Mixed interest (Parameter MV_JURTIPOS = M)

It is the combination of simple and compound interests, where:

Up to 30 days, simple interest calculation is considered.

Interest = Bill balance * (1 + (days overdue * (interest rate / 100)))

Above 30 days, compound interest calculation is considered.

Simple interest = Bill balance * (1 + (30 * (interest rate / 100)))

Interest = simple interest * ((1 + (interest rate / 100)) * (days overdue - 30)

Note

When there is no interest percentage indicated in the bill, interest is calculated by delinquency fee:

Interest = Delinquency Fee Amount * days in arrears

The financial investment by quotas or investment funds has some important characteristics so that the income on the investments made can be calculated.

The majority of existing funds present daily liquidity, but IOF is levied on redemptions effected up to the 29th consecutive day as of the date of each investment:

| Number of days | Income Limit % |

|---|---|

| 1 | 96 |

| 2 | 93 |

| 3 | 90 |

| 4 | 86 |

| 5 | 83 |

| 6 | 80 |

| 7 | 76 |

| 8 | 73 |

| 9 | 70 |

| 10 | 66 |

| 11 | 63 |

| 12 | 60 |

| 13 | 56 |

| 14 | 53 |

| 15 | 50 |

| 16 | 46 |

| 17 | 53 |

| 18 | 40 |

| 19 | 36 |

| 20 | 33 |

| 21 | 30 |

| 22 | 26 |

| 23 | 23 |

| 24 | 20 |

| 25 | 16 |

| 26 | 13 |

| 27 | 10 |

| 28 | 6 |

| 29 | 3 |

| 30 | 0 |

As of the 30th day, each investment is exempted from IOF.

Investment fund income

To calculate the income, know the number of quotas into which the capital invested was transformed, that is, how many quotas comprise the capital.

Note

The value of this quota is published in the economy section of the main newspapers every day.

First, divide the value of the investment by the value of the quota on the date of the investment. The value of quotas is usually reported with 6 decimal places.

BRL 10,000.00/BRL1.263745 = 7,912.988775 quotas.

Example:

BRL 10,000.00/BRL1.263745 = 7,912.988775 quotas

The system uses the quota registered in the contract to make this conversion while adding an investment. Investments are controlled in quotas from the moment an investment is added.

Once you know the number of quotas, multiply it by the value of the quota of the day to know its balance.

The system uses the quota registered in the contract to make this conversion while adding an investment. Investments are controlled in quotas from the moment an investment is added.

Once you know the number of quotas, multiply it by the value of the quota of the day to know its balance.

Suppose that, after twenty five consecutive days, the quota has increased in value and now corresponds to $1.283459. The multiplication result is the updated investment, that is:

7,912.988775 x BRL 1.283459 = BRL 10,156.00.

This quota must be registered in the Update Quotation option of the Bank Contract routine.

Calculation of total gross yield in the period.

To calculate the total gross income obtained in the period, consider the following calculations:

Assuming a balance in quotas of 7,912.988775 multiplied by the quota of the last working day of the previous month, or the quota on the date of investment:

7,912.988775 x 1.263745 = 10,000.00

Consider a balance in quotas of 7,912.988775 multiplied by the quota on the day of redemption or allocation minus the balance in item 1.

Gross Income: 7,912.988775 x 1.283459 – 10,000.00 = BRL 156.00.

To calculate the income proportional to the redemption, first obtain the redemption value in quotas and divide by the redemption value by the quota of the day.

Example:

1,000.00 / 1.283459 = 779.144484 (considering the redemption of BRL 1,000.00)

The value in quotas obtained in item 1 is multiplied by the quota of the last working day of the previous month or by the quota on the investment date:

779,144484 x 1.263745 = 984.64.

The value obtained in item 2 must be deducted from the redemption value to get the income value proportional to 1,000.00:

1,000.00 – 984.64 = 15.36

For better understanding, in partial redemption, the income is calculated by using cross-multiplication.

If 156.00 is the income on the updated 10,000.00, the income on 1,000.00 is:

X = ( 156.00 x 1,000.00 ) / 10,156.00 = 15.36

Where X = Income on partial redemption.

| Income | Redemption |

|---|---|

| 156.00 | 10,156,00 |

| x | 10,000.00 |

Note that, since calculation was made after twenty-five consecutive days and, hence, is NOT exempt from IOF, the value concerning IOF payable must be calculated if there is redemption or allocation.

By the tax collection table, if there is a redemption on the 25th day after investment, the amount payable as IOF will be equivalent to 16% of the income (see in the IOF table that 25 days correspond to 16% of IOF on the income).

Amount of IOF to be paid:

16% = 0.16 x BRL 156.00 = BRL 24.96

If redemption is made from the 30th day of the investment, IOF is exempted on the income.

Calculation of Income Tax on Gross Income

While calculating Income Tax on gross income, the tax is collected by the manager of the investment fund. Collecting always occurs on the last working day of the current month or at redemption, whichever is first.

If redemption is not made on the last working day of the month, the manager automatically debits its balance in quotas, equivalent to the tax amount due in the current month.

In case of a fixed income fund, the tax rate is 20% on gross income, which must be paid to the Internal Revenue Service.

The IOF due is already deducted from the gross income if the redemption is effected within 30 consecutive days period.

Thus, the IR amount to be collected without IOF levy (redemption period starting from the 30th day after the investment) is:

$ 156.00 x 20% = 0.20 = $ 31.20

If there is no redemption till the end of the month, the balance of quotas on the last working day of the month is reduced as follows:

$ 31.20 divided by $ 1.283459 (quota of the last working day of the month) = 24.309308 quotas.

IOF Levy

Consider a redemption on the 25th day shall levy IOF of $ 24.96 and, in addition, IRF:

IRF = (156.00 - 24.96) = $ 131.04 multiplied by 20% = $ 26.21

To demonstrate the calculation method of final income and the net profitability of applicable taxes, redemption on the 25th day after investment is considered, with levy of IOF and IR.

Note: If the calculated IOF is during allocation (Virtual IOF), its value is added to the income of the following month because it was only used not to calculate IR on IOF in the first month and not to calculate a lower income and a lower IR in the following month.

Profitability Calculation

a) Net Income

Gross Income – IOF – IR = BRL 156.00 – BRL 24.96 – BRL 26.21 = BRL 104.83

b) Net Profitability

Net income divided by the initial amount invested x 100 = BRL 104.83 / BRL 10,000.00

= 1.05%, in a period of 25 consecutive days.

In the following month, the investment will be calculated using the quota of the last working day of the previous month and the quota of the allocation date.

Note

The quota amount on the last working day of the previous month must be entered in the Banking Contracts file, option Update Quotation.

Quota amounts are updated after running the Monthly Allocation routine. However, if you have deleted the quota amount, then enter it manually through this option.

During redemption, as well as in monthly allocation, this file is updated with the amount of the quota entered during redemption or allocation.

CDI Investments

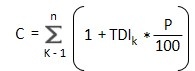

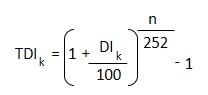

The calculation of the variation in CDI accrued between periods is performed according to the following formula:

C = result of the rates DI-CETIP Over using the percentage from the initial date (inclusive) up to the end date (exclusive), calculated with the rounding of 8 (eight) decimal places.

n = total number of rates DI-CETIP Over, where n is an integer number.

p = percentage for payment, with 4 (four) decimal places.

TDIk = Rate DI-CETIP Over, expressed in days, calculated with the rounding of 8 (eight) decimal places.

For CDI rates published up to 12/31/97, the formula DI-CETIP Over must be used:

k = 1, 2, ..., n

Example:

Percentage for payment: 97.5000.

| K | DI | TDI (DI/3000) | TDI * (P/100) | (1+TDI * (P/100)) * k-1 = Factor k |

|---|---|---|---|---|

| 1 | 16.62 | 0.00554000 | 0.00540150 | 1.00540150 |

| 2 | 16.63 | 0.00554333 | 0,00540475 | 1.01083544 |

| 3 | 16.74 | 0.00558000 | 0.00544050 | 1.01633489 |

| 4 | 16.70 | 0.00556667 | 0.00542750 | 1.02185105 |

k-1 = (1+TDI * (p/100) of k -1, except when k=1, once the multiplier is 1.

Note

This formula was used to calculate the variation because the DI-CETIP Over rate was published until 12/31/1997 on a monthly basis, however, if even after that date the rate continues to be registered with SM2 on a monthly basis, it is necessary to use the MV_BASECDI parameter so that the system calculates the income properly.

For the CDI rates published after 1/1/98, the formula must be:

k = 1, 2, ..., n

Example:

Percentage for payment: 97.5000.

| K | DI | TDI (DI/3000) | TDI (DI/3000) | (1+TDI * (P/100)) * k-1 = Factor k |

|---|---|---|---|---|

| 1 | 16.62 | 0.00061031 | 0.00059505 | 1.000580174 |

| 2 | 16.63 | 0.00061065 | 0.00059538 | 1.001161008 |

| 3 | 16.74 | 0.00061439 | 0.00059903 | 1.001745742 |

| 4 | 16.70 | 0.00061303 | 0.00059770 | 1.002329521 |

When multiplying k by CDI balance, the updated value is presented (includes interests). The interest is due to the subtraction of the updated value balance.

The Financial module uses two different mechanisms to print checks:

SIGALOJA.DLL: developed by the Commercial Automation team, this mechanism is responsible for the communication between the system and the check printer.

Note

DLL facilitates the communication between the system and the equipment, and requires internal technology development.

To print checks using these options, keep the Store Control \Smart Client DLL up to date, as well as the manufacturer's drivers.

The system does not automatically install the DLL when Active X is in use, therefore, you cannot use the printers.

Print direct in port: Financial sends all commands to the serial port (COM?) or the parallel port (LPT?) without going through the DLL in the Store Control module. To test printing in the ports, use the Check Printing routine of the Financial module.

By using the system to print, a list is displayed containing similar printer names. Each printer uses different communication methods.

In most cases, check printers use the communication via serial port (COM?). Some printers allow the computer to use a parallel port (LPT?), and there are also those that accept both types of connection (one cable for each port).

The system sends basic check data to the printer, such as:

- Code of bank.

- Name of beneficiary.

- Value of check.

- Issuing Municipality.

- Check issue date.

The printer already has settings for the check models from the different banks (recorded in an integrated circuit in the memory).

For further information on adding/editing such configurations, check the printer manual.

Note

For printers that receive direct command on the serial port (COM?) of the Financial module, note that: to print checks through these options, neither specific configuration nor intermediate files, such as DLL and drivers, is required.

Some hardware have both fiscal printer and check printer. These printers can either use the printing mechanism with the Store Control DLL or print directly on the port.

The printers table is updated whenever new approvals occur and/or the technology changes.

All check printers that use the printing mechanism supported by the Store Control DLL must have their functionality activated in the Financial module, thus, some specific Financial parameters are configured.

The system standard considers the printing mechanism directly on the port, however, there are exceptions for the Bematech and Olivetti PR-45 printers, as they have specific documentation that contains the operation description. For XTP and DATAREGIS printers, printing routines are available only in the operating system DOS 2.06 and 2.07.

To print the year with four digits on check printers, the MV_CHEQ4DG parameter indicates whether the system should send the four digits to the printer, the default being N (sends only 2 digits).

Note

For further information about setting printers, see Non-fiscal printer.

The Financial module has some functions for integration with the Excel spreadsheet:

Extenso()

Extenso(nNumToExt,lQuantid,nMoeda,cPrefixo,cIdioma,lCent,lFrac)

It generates the numeric value written in full.

Note

Parameters:

nNumToExt: Value to be generated in words.

lQuantid: It determines whether the full written mode will be in value or quantity (default = .F.).

nMoeda: It identifies the description of the currency obtained in the MV_MOEDAx parameter.

cPrefixo: Alternative prefix. If specified, it prefixes the return of the value in words, so the currency unit is not returned (default = "").

cIdioma: It specifies the language in which the value in words must be returned (1=Port,2=Spa,3=Eng). The default is the System language.

lCent: It specifies whether the function must return the cents; .T. is default.

lFrac: It specifies if the cents must be returned in fraction mode (it is executed only when cIdioma=English).

FinNatOrc()

FinNatOrc(cNatureza,cMes,nMoeda,nAno)

It returns the quoted value of the class.

Note

Parameters:

cNatureza: Class to be searched.

cMes: Month for calculation.

nMoeda: Outflow currency.

nAno: Year for calculation.

FinNatPrv()

FinNatPrv(cNatureza,dDataIni,dDataFim,nMoeda,nTipoData,lConsDtBas,lConsProvis)

Returns the estimated value of the class within the desired period.

Note

Parameters:

cNatureza: Desired class.

dDataIni: Start date for issuing or actual due date of bills, according to parameter nTipoData.

dDataFim: End date for issuing or actual due date of bills.

nMoeda: In which currency the values are returned.

nTipoData: Type of date used to search bills: 1=Issue Date; 2=Actual Due Date.

lConsDtBas: it indicates whether the balance is returned in the system database, disregarding posts made after this date, or whether the balance is returned regardless of the database.

lConsProvis: it indicates whether the values of the provisional bills should be considered.

FinNatRea()

FinNatRea(cNatureza,dDataIni,dDataFim,nMoeda,lMovBco,cTipoDat)

Returns the class accomplished value.

Note

Parameters:

cNatureza: Desired class.

dDataIni: start date of input or posting movement, according to parameter cDatType.

dDataFim: end date of input or posting movement, according to parameter cDatType.

nMoeda: it indicates the currency in which the values are returned.

lMovBco: 0=indicates that posts that do not move bank balance must not be consolidated; 1=indicates that posts that do not move the bank balance must be consolidated.

cTipoDat: date to be used within the period entered in dDataIni and dDataFim: DG = input date and DT = transaction date.

RecMoeda()

RecMoeda(dData,cMoeda)

It returns the exchange rate of a currency on a given date.

Note

Parameters:

dData: Desired date for quotation.

cMoeda: Code of the desidered currency.

SldBco()

SldBco(cBanco,cAgencia,cConta,dData,nMoeda,lLimite)

Returns bank balance as on a date.

Note

Parameters:

cBanco: Bank code (blank; all).

cAgencia: Branch code (blank; all).

cConta: Checking account code (blank; all).

dData: Balance date.

nMoeda: Code of the currency for the balance.

lLimite: it defines whether the check overdraft limit is considered to compose the balance (.T. = Consider; .F. = Do not consider).

SldReceber()

SldReceber(dData,nMoeda,lDtAnterior,lMovSE5)

It returns the balance receivable on a given date.

Note

Parameters:

dData: Balance date.

nMoeda: Code of the currency for the balance.

lDtAnterior: it indicates whether to report the balance up to the date entered, or only the balance on the date entered in dData.

lMovSE5: it indicates whether to consider only pending balance or posted balances as well (.T. = Consider posted balance; .F. = Do not consider posted balance).

SldPagar()

SldPagar(dData,nMoeda,lDtAnterior,lMovSe5)

It returns the balance payable on a given date.

Note

Parameters:

dData: Balance date.

nMoeda: Code of the currency for the balance.

lDtAnterior: it indicates whether to report the balance up to the date entered, or only the balance on the date entered in dData.

lMovSE5: it indicates whether to consider only pending balance or posted balances as well (.T. = Consider posted balance; .F. = Do not consider posted balance).

VlrCliente

VlrCliente(cCliLoja,dDtIni,dDtFin,nMoeda,lConsAbat,lConsAcresc,lConsDecresc)

Returns the value of the customer's bills during a period.

Note

Parameters:

cCliLoja: Customer code, including the store.

dDtIni: Start date for issuing the customer's bills.

dDtFin: End date for issuing the customer's bills.

nMoeda: Currency intended for the values.

lConsAbat: It indicates whether discount bills should be considered for composing the bill amounts.

lConsAcresc: It indicates whether the increments in the customer's bills should be considered.

lConsDecresc: It indicates whether the deductions in the customer's bills should be considered.

VlrFornece

VlrFornece(cForLoja,dDtIni,dDtFin,nMoeda,lConsAbat,lConsAcresc,lConsDecresc)

Returns the value of the supplier's bills during a period.

Note

Parameters:

cForLoja: Supplier code, including the store.

dDtIni: Start date for issuing the supplier's bills.

dDtFin: End date for issuing the supplier's bills.

nMoeda: Currency intended for the values.

lConsAbat: It indicates whether discount bills should be considered for composing the bill amounts.

lConsAcresc: It indicates whether the increments in the supplier's bills should be considered.

lConsDecresc: It indicates whether the deductions in the supplier's bills should be considered.

SldCliente()

SldCliente(cCliLoja,dData,nMoeda,lMovSE5)

It returns the balance receivable from the customer on a given date.

Note

Parameters:

cCliLoja: Customer code, including the store.

dData: Balance date.

nMoeda: Code of the currency for the balance.

lMovSE5: it indicates whether to consider only pending balance or posted balances as well (.T. = Consider posted balance; .F. = Do not consider posted balance).

SldFornece()

SldFornece(cForLoja,dData,nMoeda,lMovSE5)

It returns the balance payable to the supplier on a given date.

Note

Parameters:

cCliLoja: Customer code, including store.

dData: Balance date.

nMoeda: Code of currency for the balance.

lMovSE5: it indicates whether to consider only pending balance or posted balances as well (.T. = Consider posted balance; .F. = Do not consider posted balance).

Media()

Media(nMoeda, nMes, nAno)

It returns the average rate of a currency in a given month/year.

Note

Parameters:

nMoeda: Currency code.

nMes: Desired month.

nAno: Desired year.

xMoeda

xMoeda(nValor,nMoedp,nMoedd,dData,nDecimal,nTaxap,nTaxad)

Converts the amounts between currencies.

Note

Parameters:

nValor: Value to convert.

nMoedp: Source currency.

nMoedd: Target currency.

dData: Date of target currency rate.

nDecimal: Number of decimal places.

nTaxap: Source currency rate.

nTaxad: Target currency rate.

| Integration between Material and Financial modules |

|---|

|

While implementing the Material module, set the work model of the Financial module. The main criteria are:

For this, it is important to observe how the integrations are carried out between them and, as an example, input and output documents are used, because they are integrated into the Financial module through the generation of receivable and payable bills. In this case, the following parameters are used:

Accounts Payable The primary key of the accounts payable bill is composed of the following fields: PREFIX + NUMBER + INSTALLMENT + TYPE + SUPPLIER + STORE They must be completed as follows:

Supplier/Store: are filled in with the supplier/store data of the inbound document. Note The Financial Class is not part of the primary key of the accounts payable bill, but since it is required information, it must always be filled out. Accounts Receivable The primary key of the accounts receivable bill is composed of fields: PREFIX + NUMBER + INSTALLMENT + TYPE They must be completed as follows:

Note The Financial Class is not part of the primary key of the accounts payable bill, but since it is required information, it must always be filled out. This way, it is possible to perceive the importance of defining the MV_1DUP parameter for the perfect completion of bill terms and of the MV_1DUPNAT and MV_2DUPNAT parameters for entering and using the Financial Classes. The parameters MV_1DUPPREF and MV_2DUPPREF are equally important in relation to the others mentioned, because they make it possible to change the primary key of financial bills after saving. Example: Assuming that the tables in the Financial module are shared and the Materials tables are exclusive. As the prefix can be changed after the table is saved, you cannot be sure the financial bills are not duplicated if you do not change these parameters when you define the access method to the tables of the Financial module. Thus, if the method of sharing of the Financial module is changed, it is necessary to ensure, through parameters MV_1DUPPREF and MV_2DUPPREF, that there is no duplication of the primary key of their tables. Parameter MV_1DUPPREF filled out with: ExecBlock('1DUPPREF',.F.,.F.). User Function creation: User Function 1DupPref() Local aArea : GetArea() Local aAreaSE1: SE1->(GetArea()) Local cPrefixo : SubStr(AllTrim(xFilial('SF2')+SE1->E1_SERIE),1,3) dbSelectArea('SE1') dbSetOrder(1) While MsSeek(xFilial('SE1')+cPrefixo+SE1->E1_NUM+SE1->E1_PARCELA+SE1->E1_TIPO) .And. aAreaSE1[3] <> SE1->(RecNo()) cPrefixo : Soma1(cPrefixo) EndDo RestArea(aAreaSE1) RestArea(aArea) Return(cPrefixo) Note If the access method defined by TOTVS® is used, there is no need to change the parameters MV_1DUPPREF and MV_2DUPPREF. |

| Integration between HR and Financial modules |

|---|

When the totalizer is generated for HR, concerning data of block F100 of SPED PIS/COFINS, a file is generated to check data in the SYSTEM folder. File name: FIN + Branch Code (if the table is exclusive) + DES + Reference Month and Year + .DBF Layout: BRANCH + PREFIX + NUMBER + INSTALLMENT + TYPE + CUSTOMER + STORE + DATE + CLASS + VALUE + TABLE Example: Example of name of the file generated for August, 2015 from branch 01: FIN01DES082015.DBF |

| Integration between Purchase and Financial modules |

|---|

|

This integration includes meeting the legislation dedicated to ISSQN Withholding in the municipality of São Bernardo do Campo. The system calculates withholding on bills when the entry of service inbound documents is carried out through the Purchase module.

In this case, the following criteria must be considered:

Configuration of specific fields of table SE4:

Note Fields E2_VRETISS and E2_VBASISS are for system control and should not be edited.

Note This field meets the same systematics implemented in the addition of Service Invoices of the Purchase module (pursuant to legislation). If this field is already part of the dictionary/database, you must only enable it. Configuration of Specific Fields of Table SE4:

Note When this field is blank, the default is considered, that is, Yes. |

Parameters/Settings

Microsiga Protheus® uses standardized or specific configurations in its routines, which are called parameters. It is a variable that works as a key element in the execution of certain processes. Its content may yield different results.

All variables begin with the MV_ prefix, and act on various operations. For example, MV_JUROS, which defines a standard for the financing rate negotiated with suppliers during quotation process negotiations.

The Financial module uses several parameters, some of which are also used by other modules and, when changed, their new contents apply to all modules involved.

Some parameters are only generic configurations, such as: the configuration of peripherals (printers), opening dates, currency terminology, etc.

Note

You must query parameters starting with numbers after the MV_ prefix in item #.

You can change the parameter contents in the Parameters routine of the Configurator module.

The parameters used in the Financial module of Microsiga Protheus® are:

| Name | Description | Content |

|---|---|---|

| MV_1DUP | It defines the start of the first installment of the generated bill. Example: A - For Alpha sequence. 1 - For Numerical sequence. |

A |

| MV_1DUPNAT | Field or data for registering the class of the bill. When it is generated automatically by the Billing module. | SA1->A1_NATUREZ |

| MV_1DUPREF | Field or data for registering the prefix of the bill. When it is generated automatically by the Billing module. | SF2->F2_SERIE |

| MV_2DUPNAT | Field or data for registering the class of the bill. When it is generated automatically by the Purchase module. | SA2->A2_NATUREZ |

| MV_2DUPREF | Field or data for registering the prefix of the bill. When it is generated automatically by the Purchase module. | SF1->F1_SERIE |

| MV_3DUPREF | Field or data for recording the bill's prefix, when it is automatically generated by the Commission Update routine (E2_PREFIXO). | COM |

| Name | Description | Content |

|---|---|---|

| MV_AB10925 | Mode concerning the exemption of withholding for PIS/COFINS/CSLL. 1-Evaluation by invoice/bill. 2-Evaluation by the sum of invoices/bills per customer/store/month/year. |

|

| MV_ACENTO | It identifies whether accent marks are used in the System. N for compatibility with the DOS version. |

N |

| MV_ACMINSS | It defines whether accrued INSS values are considered by issue date or due date of the bill. 1 - Issue. 2 - Actual due date. |

1 |

| MV_ACMIRPF | It defines the cumulative period considered for application of the IRRF-PF progressive table: 1 - Issue. 2 - Actual maturity (expected payment date). 3 - Accounting date. |

1 |

| MV_ACMIRPJ | It defines the cumulative date to be considered, to check whether the company reached minimum withholding value, in case of legal entity: 1 - Issue. 2 - Actual maturity (expected payment date). 3 - Accounting date. |

1 |

| MV_ACMIRRF | It defines whether to accumulate the minimum IRRF tax amount: 1 - Accumulates 2 - Does not accumulate |

1 |

| MV_AG10925 | Indicate whether the CCP taxes will be combined in one bill only when the three taxes in the same bill occur. 1 - Groups 2 - Does not group |

2 |

| MV_AGDMEN | Loads the schedule (DOS version). Defines whether it is automatically loaded, if any message arrives during the day. |

N |

| MV_AGENTE | It indicates whether the customer is a withholding agent of different taxes. To use this parameter in ISI withholding, add an S in the eighth position, leaving spaces for the sixth and seventh positions. |

SSSSSS |

| MV_AGLIMPJ | It defines how IRRF base is made to check the minimum withholding value. 1 - Current branch only. 2 - All branches by the CNPJ. 3 - All branches by CNPJ first 8 digits. |

1 |

| MV_AGLROT | It indicates whether the accounting grouping should consider the generating routine. | N |

| MV_ALIQIRF | IRRF rate for bills with withholding. The percentages are used according to the legal table. |

3 |

| MV_ALIQISS | ISS Rate uses percentages defined by the Municipality in cases of rendering of services. When you use various ISS rates, use the ISS Multiple Relationships routine. |

5 |

| MV_ALIQIVA | It defines the VAT withholding rate. | 0.00 |

| MV_ALTLIPG | It checks whether the bill approved for payment can be edited. S - Editable. N - Not editable. |

|

| MV_ANTCRED | It allows posting the bill receivable with a credit date earlier than the bill issue date. | F |

| MV_APLAPRO | It indicates whether SEI is used to search for data in block F100 of SPED, in the appropriation of investments, or whether SE5 is used (.F.). | .T. |

| MV_APLCAL1 | It indicates which investment operations use the calculation of income by percentage on a certain currency on a daily basis. | CDI |

| MV_APLCAL2 | It indicates which investment operations use the calculation of income as compound interest and exchange rate. | CDB/RDB |

| MV_APLCAL3 | It indicates which investment operations use the calculation of income as simple interest and exchange rate. | CP |

| MV_APLCAL4 | It indicates which investment operations use the calculation of income as quotas/bills. | FAF |

| MV_APLFIN | It activates the sending of financial investments in block F100 of SPED. | .F. |

| MV_APLNAT | It indicates the class of the financial investments sent in block F100 of SPED. | Empty |

| MV_APLVCAB | It indicates the number of days to be considered to calculate the exchange rate. | 0 |

| MV_APRPAG | Number of days considered for approval, based on the actual date due. If filled out, the use of payment approval is considered. |

1 |

| MV_ATUSAL | It indicates whether accounting balances are updated during entry. | S |

| MV_ATUSI2 | It indicates the update mode of on-line accounting entries. | O |

| MV_ATVCIMP | It allows you to change the due dates of tax bills, IRRF, PIS, COFINS and CSLL, when the main bill is posted, where: F(false): It does not alter the due date of the tax bills while posting the main bill. T (true): it alters the due date of tax bills while posting the main bill, recalculating them based on the date of posting of the main bill. |

|

| MV_AUTOCON | It checks whether the check printer has defined layouts or whether they must be retrieved from the system. | T |

| MV_AVPCTB | Number of processes (threads) used in the accounting of value adjustments (routines Calc. AVP CR and Calc. AVP CP). Minimum - 1 Maximum - 15 |

1 |

| MV_AVPTHR | The number of processes (threads) used in the calculation of current value adjustments (routines Calc. AVP CR and Calc. AVP CP). Minimum - 1 Maximum - 15 |

1 |

| Name | Description | Content |

|---|---|---|

MV_BASECDI |

It defines how the CDI rate is registered, whether on a monthly or yearly basis. 1 - Monthly. 2 - Yearly. The way in which the rate is registered is decisive for the Financial module to calculate the income of a financial investment of the CDI type using the variation correctly. |

|

| MV_BDVCIMP | It changes the maturity of taxes (IR, PIS, COFINS and CSLL) considering the maturity of the main bill when transferred via tax invoice. | .F. |

| MV_BLALOT | Number of records per batch for processing threads in SITEF reconciliation. | 1 |

| MV_BLATHD | Number of threads for processing SITEF reconciliation. Maximum of 20. | 1 |

| MV_BLVLDES | It defines whether you will be allowed to change the value of breakdown installments in the tracked process (MV_NRASDSD = .F.). .T. = It blocks the alteration of the value field of the breakdown installments, when there is tracking control (Default); .F. = It allows the value of the breakdown installments to be changed, even when there is tracking control. |

.T. |

| MV_BOTFUNP | It is used in the Accounts Payable routine functions to group some routines in option sub-groups. .T. - Displays grouped options. .F. - Does not group options. |

.F. |

| MV_BOX | It defines whether the Combobox is used to list options registered in X3_CBOX. | S |

| MV_BP10925 | It defines whether to consider the payment amount, the gross amount of the partial post or the net amount with taxes. (1=Gross Amt./2=Net Amt.) | 1 |

| MV_BQ10925 | It defines whether to consider the payment amount, the gross amount of the partial post or the net amount with taxes. 1 - Gross Amount. 2 - Net Amount. |

1 |

| MV_BR10925 | It defines the moment of PIS, COFINS and CSLL tax amount posts, where: 1 - Tax deduction at document posting. 2 - Tax deduction at document issue. |

2 |

| MV_BX10925 | Withholding of PCC tax calculated during bill posting. | 1 |

| MV_BXBORDE | It indicates the use of the keys [Alt] + [B] for posting. Upon selection, it consider only posted bills for the bordereau. |

N |

| MV_BXCNAB | It defines whether the CNAB return bill posts must be grouped. S: groups posting transaction. For the total transactions per Bank+Agency+Account+Date. N: does not group posting transaction. For totalizing transactions per date. |

N |

| MV_BXINSAU | Posting of INSS bills withheld in Advance Payment (AP) 1 = Yes or 2 = No. | 2 |

| Name | Description | Content |

|---|---|---|

| MV_CALCCM | It indicates whether the indexation is calculated. | S |

| MV_CANBORP | It indicates whether cancellation of main bill post is deleted from SEA (Bordereaux). S - Deletes from bordereau. N - Does not delete from bordereau. |

S |

| MV_CANLIPG | It checks whether the bill approved for payment that was changed requires approval again. S - Yes. N - No. |

|

| MV_CARTEIR | It defines the codes of banks in the portfolio. | Blank - to be filled out |

MV_CENT |

Number of decimal places used for printing the amounts in currency 1. | 2 |

| MV_CENT2 | Number of decimal places used for printing the amounts in currency 2. | 2 |

MV_CENT3 |

Number of decimal places used for printing the amounts in currency 3. | 2 |

| MV_CENT4 | Number of decimal places used for printing the amounts in currency 4. | 2 |

| MV_CENT5 | Number of decimal places used for printing the amounts in currency 5. | 2 |

| MV_CHEQ4DG | It indicates whether the System sends four digits to the printer. N - Sends only 2 digits. This parameter is only used by Bematech printer in versions 4.08; 4.07 and 4.06 of the system. |

N |

| MV_CHQBOR | Indicates whether the check number is allowed when the bill is in bordereau. | S |

| MV_CIDE | Classes for manual CIDE taxes. | CIDE |

| MV_CLIPAD | Default customer for post-dated checks. | 000001 |

| MV_CMC7FIN | Indicates the use of CMC7 reader in the Financial module. | S |

| MV_CMC7MOD | Indicates the CMC7 model used in the Financial module. Example: CMC7 Bematech or CMC7 Pertochek. |

|

| MV_CMC7PRT | It indicates the communication port used by CMC7 reader in the Financial module. Example: COM1. |

" " |

| MV_CNABCC | It identifies saving the processing of the CNAB file in the knowledge base. 1 - Saves. 2 - Does not save. |

|

| MV_CNFI350 | It indicates whether monetary variation is to be accounted by the FINA350 routine for provisional bills generated by the Contract Management module. | T |

| MV_CNRETTC | It indicates the type of bill payable generated in the Financial module through the posting of the purchase contract retention in the Contract Management module. | NDF |

| MV_CNRETTV | It indicates the type of bill receivable generated in the Financial module through the posting of the sales contract retention in the Contract Management module. | NCC |

| MV_COFINS | Defines the class for the bills concerning COFINS. | COFINS |

| MV_COMICOF | It indicates whether COFINS is considered for commission payment. S - Considers. N - Does not consider. |

|

| MV_COMICSL | It indicates whether CSLL is considered for commission payment. S - Considers. N - Does not consider. |

|

| MV_COMIDAC | It indicates whether a commission calculation is performed in the posting by Dation: F - No. T - Yes. |

F |

| MV_COMIDEV | It indicates whether commission is calculated during posting by return or in the return invoice. T - True. F - False. |

F |

| MV_COMIINS | It indicates whether the INSS value is considered in the commission payment calculation. | N |

| MV_COMILIQ | 1 - Commission generation during settlement. 2 - Commission generation during posting. |

2 |

| MV_COMIPIS | It indicates whether PIS is considered for commission payment. S - Considers. N - Does not consider. |

|

| MV_COMISCR | Indicator that allows calculating commission for sales representative in CR clearance. | S |

| MV_COMISIR | It indicates whether IR value is considered on the commission base. | N |

| MV_COMISAB | Subtracts Bill AB- from the commission calculation base? .T. → Commission Base = Bill - AB- .F. → Commission Base = Bill |

.F. |

| MV_COMP | ASCII character to zip the printer. Enter the character decimal code. |

15 |

| MV_COMPCP | It indicates whether in an Invoice clearance with a PA, the taxes are proportionated. | .F. |

| MV_COMPCR | It indicates whether in an Invoice clearance with an RA, the taxes are proportionated. | .F. |

| MV_COMPNC | This parameter is used in localized countries. Enables to configure the suggestion screen of NCC and NDE bill clearing, being: 1 - Always displays the screen for clearing. 2 - Never displays the screen for clearing. 3 - Displays a question requesting confirmation to display the clearance screen. |

3 |

| MV_CONSBCO | Checks whether bills in bordereau are automatically selected for those ones whose customer has a bank selected in the register. | F |

| MV_CONSFIL | It indicates whether to consider all company branches in PCC calculation. .T. - Considers all branches. .F. - Does not consider all branches. |

.F. |

| MV_CONTSB | It indicates whether offline accounting is done even when values are different. It does not display the accounting entry or displays it with diverging values. | N |

| MV_COPCHQF | It indicates which supplier name is printed on the check copy, where: 1 - Reduced name. 2 - Company name. |

|

| MV_CPIMPAT | It indicates whether taxes due are to be automatically cleared. 1 - Automatic. 2 - Manual (default content). |

2 |

| MV_CSLL | Class of CSLL payment bills. | CSLL |

| MV_CTBAIXA | Type of post accounting; Accounts Payable. B - Post, during generation. C - Check. A - Both cases. |

C |

| MV_CTBSERZ | Deletion control of semaphore file. T - Yes. F - No. |

T |

| MV_CTLIPAG | Controls write-offs payable through the approval date filled out. T: the system checks whether the Approval Date (E2_DATALIB) field is filled out. F: Does not control. |

F |

| MV_CTVALZR | It indicates whether it is accounted when value 1 is equal to zero or when there is another value different from zero. | N |

| MV_CUSFIFO | It defines whether the FIFO cost is also calculated when the average cost is calculated. | F |

| MV_CXFIN | It indicates the code of the bank, branch and account of internal cashier (separated by / (slash)]. | CX1/000/000 |

| Name | Description | Content |

|---|---|---|

| MV_DATAATE | Final accrual date for typing the entries. Valid for Accounting. Example: 12/31/XXXX |

Final date of fiscal year |

| MV_DATADE | Start date for typing the entries. Valid for Accounting. Example: 12/31/XXXX |

Final date of fiscal year |

| MV_DATAFAT | It indicates the date of invoice issue; TMS module. | dDataBase |

| MV_DATAFIN | Deadline for financial transactions. Example: 01/01/XX. |

01/01/XX |

| MV_DATAREC | Deadline for bank reconciliation. | 01/01/XX |

| MV_DCSSPD | It indicates the series of the outbound documents generated in block F100 of SPED. | Empty |

| MV_DEDBCOF | It defines the taxes to be considered to compose the COFINS calculation base. The configuration of this parameter follows the description of the MV_DEDBPIS parameter. |

|

| MV_DEDBPIS | Duties to be considered to define PIS calculation base. The content may be: I - ICMS only: only when there is ICMS credit. The system deducts the ICMS value to compose the PIS calculation base. P - IPI only: only when there is no IPI credit. The system sums the IPI amount to compose the PIS calculation base. S - Both: treats both ICMS and IPI, according to previous contents. N - None: PIS calculation base is the total amount of the invoice, that is, goods value + freight + insurance + extra expenses - discounts - reduction (if any). |

|

| MV_DELFSEV | It indicates whether records are physically deleted from the SEV table upon deleting a bill payable. T - Physically delete. F - Do not physically delete. |

T |

| MV_DESCDOC | It enables fields E1_HIST and E2_HIST to send the description of operation/documentation in block F100 of SPED PIS/COFINS. | |

| MV_DESCFIN | It indicates whether the financial deduction is applied fully to the first installment or proportionally to the amount paid for each installment. I - Fully at the first payment. P - Proportional to the amount paid for each installment. |

I |

| MV_DESCRF | It activates the sending of non-taxable financial revenue discounts in the F100 block of SPED. | .T. |

| MV_DIADESC | Use it to check whether the system postpones the deadline for financial discount to the next business day. | F |

| MV_DIAISS | Default date for generating ISS bills. | 10 |

| MV_DIASCTB | Indicates the number of days in the fiscal year. | 360 |

| MV_DIASPRO | Number of days for inflation projection, in the Currency Projection option. | 120 |

| MV_DIFCAMP | It defines whether the automatic exchange difference routine is used in payment order. S – Yes. N - No. |

N |

| MV_DIFCAMR | It defines whether the automatic exchange difference routine is used in miscellaneous collections. S – Yes. N - No. |

N |

| MV_DIFPAG | It indicates whether the system controls different types of taxes in the SISPAG return file. T – True: the system handles different configurations. F – False: the system allows one configuration for each return file, making no distinction between them. |

T |

| MV_DIRETI2 | It indicates whether accounting will be direct without using Acols: S – Yes. N - No. |

N |

| MV_DIRLOG | Target directory to automatically store the production control log files generated by the system. | Blank - must be filled out |

| MV_DOCSPD | It indicates the kind of the inbound documents generated in block F100 of SPED. | Empty |

| MV_DRIVER | Default printer driver. | EPSON |

| MV_DTDESCF | Field of SE1 that considers as a starting point for calculating the financial discount. | E1_VENCORI |

| MV_DTMOVRE | It allows the use of a retroactive date from the system database to include bank transactions. | .F. |

| Name | Description | Content |

|---|---|---|

| MV_EAIPASS | Enter the user password; optional, if the server requires authentication. | |

| MV_EAIURL2 | Enter the address of the WebService that receives the data. | |

| MV_EAIUSER | Enter the user name; optional, if the server requires authentication. | |

| MV_EFF0007 | It indicates the field of the customer register that contains the ledger account for accounting financing in SIGACTB. | A1_CONTA |

| MV_EMPAPRO | It indicates loan operations that use the standard monthly allocation method. | EUR |

| MV_EMPCAL1 | It indicates loan operations that use interest calculation in a simple way; allocation is always per month. | EUR |

| MV_EMPCAL2 | It indicates loan operations that use interest calculation in a simple way and the allocation is per day. | FIN/COM/TAN/ ALD/TIB/HOT |

| MV_EMPCAL3 | It indicates loan operations that use compound interest calculations and the allocation is per day. | EMP |

| MV_EMPCAL4 | It indicates loan operations that use standard (foreign) compound interest calculation. | " " |

| MV_ESTCHOP | S - To save a reversal transaction. N - To delete the transaction. |

N |

| MV_ESTDESC | It indicates whether a reversal of deducted collection occurs when the bill returns to the portfolio. | S |

| MV_ESTORDP | It defines whether a reversal entry is made to SE5 when canceling a payment order. S – Yes. N - No. |

N |

| MV_EXERC1 | Pending fiscal year in currency 1. Enter the year when accounting starts. |

20XX |

| MV_EXERC2 | Pending fiscal year in currency 2. Enter the year when accounting starts. |

20XX |

| MV_EXERC3 | Pending fiscal year in currency 3. Enter the year when accounting starts. |

20XX |

| MV_EXERC4 | Pending fiscal year in currency 4. Enter the year when accounting starts. |

20XX |

| MV_EXERC5 | Pending fiscal year in currency 5. Enter the year when accounting starts. |

20XX |

| MV_EXPTDSP | It allows changing the availability date in the integration of the Banking Transactions routine (FINA100). | .F. |

| Name | Description | Content |

|---|---|---|

| MV_ FINQTDD | Number of days before due date for use in the conditional discount. | 0 |

| MV_ FINVERI | Prefix of the bills where posting has been locked; if there are registration bills pending MV_FINPRE - empty for all. | |

| MV_F240QRY | It indicates the indexes used to make the search through the Search option in Payment Bordereau. F - in all records in the index dictionary. T - only in the initial process index. |

F |

| MV_FATFIL | It indicates the invoice's debit branch. It is used in the TMS module. |

|

| MV_FATOUT | Time (in seconds) the user has to select the record. The screen closes if there is a delay in relation to the set time. | 900 |

| MV_FATPREF | Displays the prefix of the transport invoice bill. | |

| MV_FAVOR | It checks whether to show the payee when printing checks. | T |

| MV_FILINSS | It indicates whether the INSS calculation should consider branches that have the same first CNPJ 8 digits. |

F |

| MV_FIN016D | It indicates whether to physically delete the records in upon collector commission recalculation. T - Physically delete. F - Does not physically delete. |

T |

| MV_FIN401D | It indicates whether to physically delete the records from the Generate data for DIRF routine. T - Physically delete. F - Does not physically delete. |

T |

| MV_FIN440D | It indicates whether to physically delete the records in upon sales representative commission recalculation. T - Physically delete. F - Does not physically delete. |

T |

| MV_FINALAP | It indicates the default authority control approver code. | |

| MV_FINATFN | It indicates how Cash Flow is made: 1 - Online cash flow. 2 - Offline cash flow. |

1 |

| MV_FINAUT | It performs bill authentication: T - Authenticates. F - Does not authenticate. |

T |

| MV_FINCHQC | Municipality name for check printing. Example: São Paulo. |

|

| MV_FINCOBR | Status types which mark a bill as collection. | |A|B|C|D|E|F| |

| MV_FINCPRG | Generic code of payment term used in tax receipts for rendering of Petty Cash accounts. | |

| MV_FINCQ | It enables quality inspection verification when paying bills to the supplier. | .F. |

| MV_FINCTA | It indicates the petty cash transaction clearance option, based on the simple clearance or authority clearance formats. 1 - Simple clearance; 2 - Authority. |

1 |

| MV_FINCTMD | It enabled the financial processes of Accounts Payable / Accounts Receivable: 1 - Model I. 2 - Model II. |

1 |

| MV_FINCUST | Status types which mark a bill as custody. | |1|2|3|4|5|6|7|8|9| |

| MV_FINFPGT | Available payment methods: | |1|2|3|4|5|6| |

| MV_FINJRTP | Used to manage bills (Accounts Payable and Accounts Receivable) when the fields Delinquency Fee and Interest Percentage are filled in, respectively. By default, if the Delinquency Fee and Interest Percentage fields of the bill are filled out, the system always considers the Delinquency Fee upon posting. When configuring the parameter, if both fields have been filled out, the following options may be selected: 1 - Applies only delinquency fee. 2 - Applies only interest. 3 - Applies delinquency fee and interest. |

1 |

| MV_FINLOG | It indicates whether the Off-line Accounting routine generates a log of non-accounted records. T - Generates record log. F - Generates record log as alerts. |

F |

| MV_FINLOGO | Path to the background image shown in the Treasury-Cash routine. | \system\logoFina220.jpg |

| MV_FINPRDS | Deduction percentage used in the advance payment deduction rule. | 0 |

| MV_FINPRE | Registration bill prefix for analysis of delinquent bills. | MAT |

| MV_FINPSGR | It locks the option of partial cash withdrawal during cash closing. T - Blocks. F - Does not block. |

T |

| MV_FINPSQ | It indicates whether to consider the expiration period in the query of the Treasury-Cash routine. T - Considers. F - Does not consider. |

T |

| MV_FINTRC | Checks start change upon cash closing. T - Yes. F - No. |

T |

| MV_FMINISS | It determines whether ISSQN withholding checks the minimum amount by the calculation base. 1 - Yes 2 - No |

2 |

| MV_FORINSS | Default supplier for INSS bills. | INSS |

| MV_FORNCOM | It indicates which is the default code for the sales representative of the suppliers’ register when implementing a bill receivable. | VENDER |

| MV_FORSEST | Displays the standard supplier for SEST bonds. | SEST |

| Name | Description | Content |

|---|---|---|

| MV_GERADIP | It determines which routine is used to add advance bills when generated by the Purchase Order routine. 1 - Add advance bills to the Accounts Payable routine. 2 - Add advance bills to the Payment Order routine. |

1 |

| MV_GERIMPV | It determines whether the company uses a script for calculating variable taxes (internationalization). | N |

| MV_GPEEXTT | It allows deleting from the Financial module the bills generated by the Personnel Management module. | .T. |

| MV_GRETIVA | It determines whether VAT withholding is per item or header: S – Item. N – Header. |

N |

| Name | Description | Content |

|---|---|---|

| MV_IMPADT | Defines the usage of IRRF generation in advance payable. | S |

| MV_IMPESPE | Default printer to print checks. | XPT |

| MV_IMPSEQ | Defines whether to print sequence for copy. | Blank - must be filled out |

| MV_IMPSX1 | Defines whether to print questions in the report header. | S |

| MV_IMPTRAN | Defines when the branch and taxes will be generated: 1 - Source Branch (in transfer). 2 - Target Branch (in post). |

|

| MV_IMPVER | It indicates whether the reverse of the personalized check is printed. | N |

| MV_IN480 | It indicates the due date of the IRPF bill, according to the Normative Instruction SFR 480: 3 - Third working day. 5 - Fifth working day. |

3 |

| MV_IN4815 | It indicates whether IN SRF 480 should be considered for the calculation of the relative maturity: Q - two weeks. S - one week. |

S |

| MV_INSACPJ | It defines the INSS accrual rule for legal entity type suppliers: 1 - Accrues. 2 - Does not accrue. |

2 |

| MV_INSS | Class of INSS payment bills. | INSS |

| MV_IPPRJAP | It prints the projected redemption of investments. | S |

| MV_IRF | Class used for income tax. | IRF |

| MV_ISS | Rate used for service tax. | ISS |

| Name | Description | Content |

|---|---|---|

| MV_JURFAT | It indicates whether interest of original bill is part of the value of new invoice: .T. - Composes value. .F. - Does not compose value. |

.F. |

| MV_JUROS | Rate entered to calculate the current value of purchase quotations. | 5.0000 |

| MV_JURTIPOS | The interest for bills receivable can be: (S) simple up to 30 days of arrears and compound. | M |

| MV_JURXFIN | Enables SIGAFIN x SIGAPFS integration. .T. – Enables. .F. - Does not enable. |

.T. |

| Name | Description | Content |

|---|---|---|

| MV_LIBCHEQ | Option for release of bank balance when checks are generated before being posted. | N |

| MV_LIBNODP | It evaluates credit for orders that do not generate trade notes. | N |

| MV_LIMINSS | It defines the maximum withholding value for INSS of an individual. | 0 |

| MV_LOGERRO | It indicates how many error LOGS must be stored in the ERROR.LOG file. | 1 |

| MV_LOGSIGA | Identifier for operation control and generation of Log based on the operations made. | NNNNN |