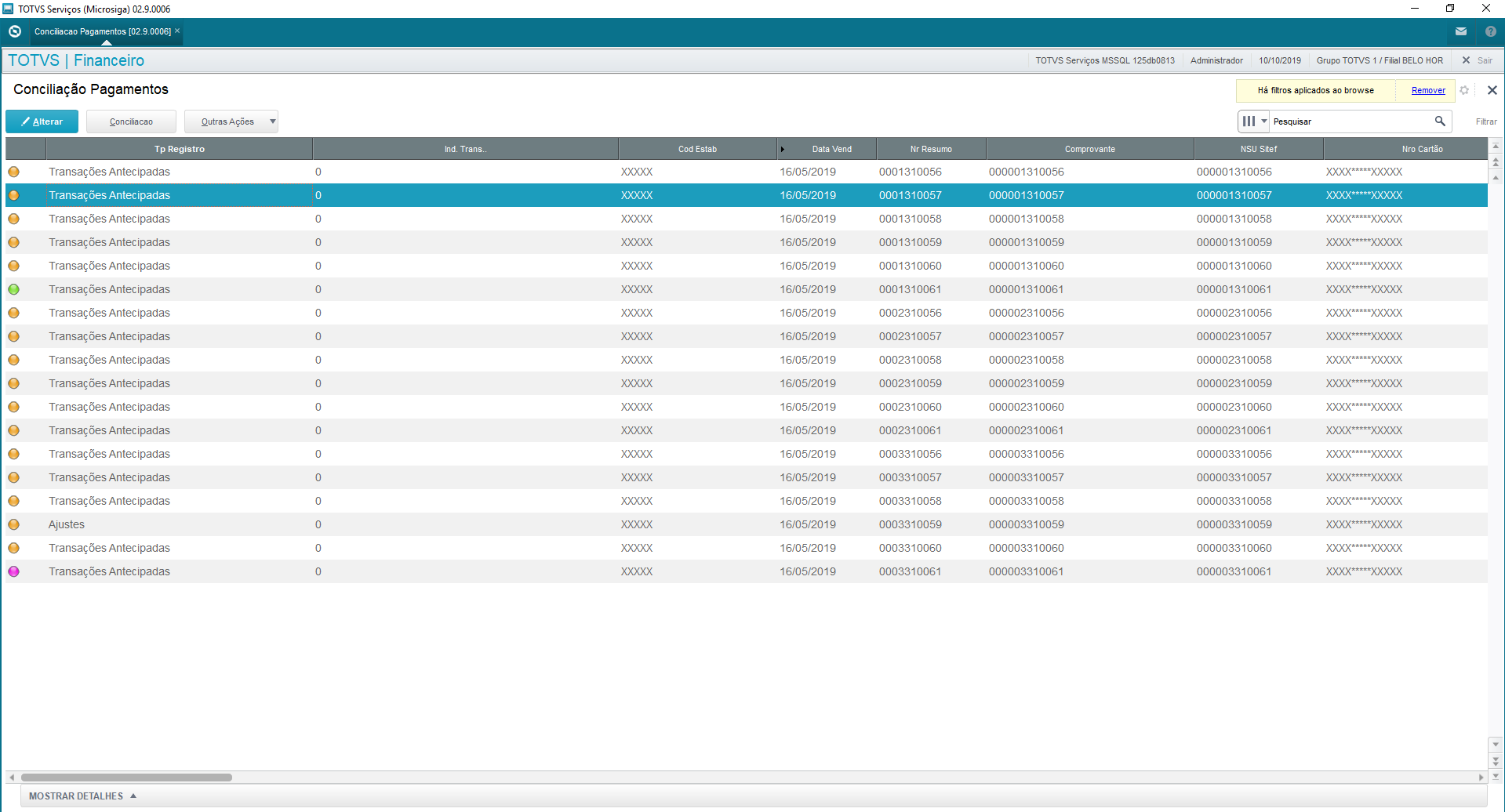

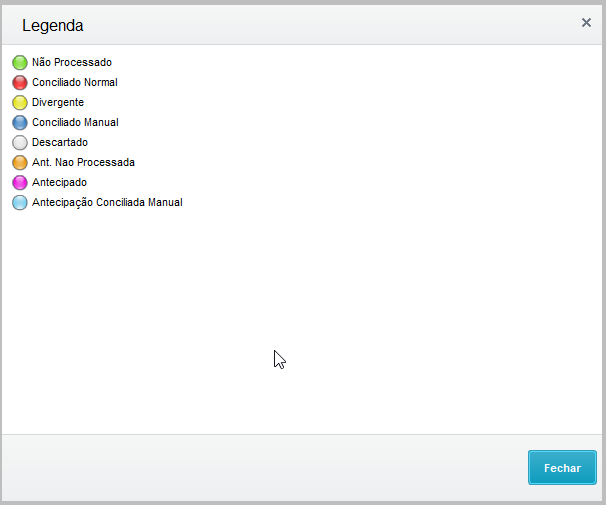

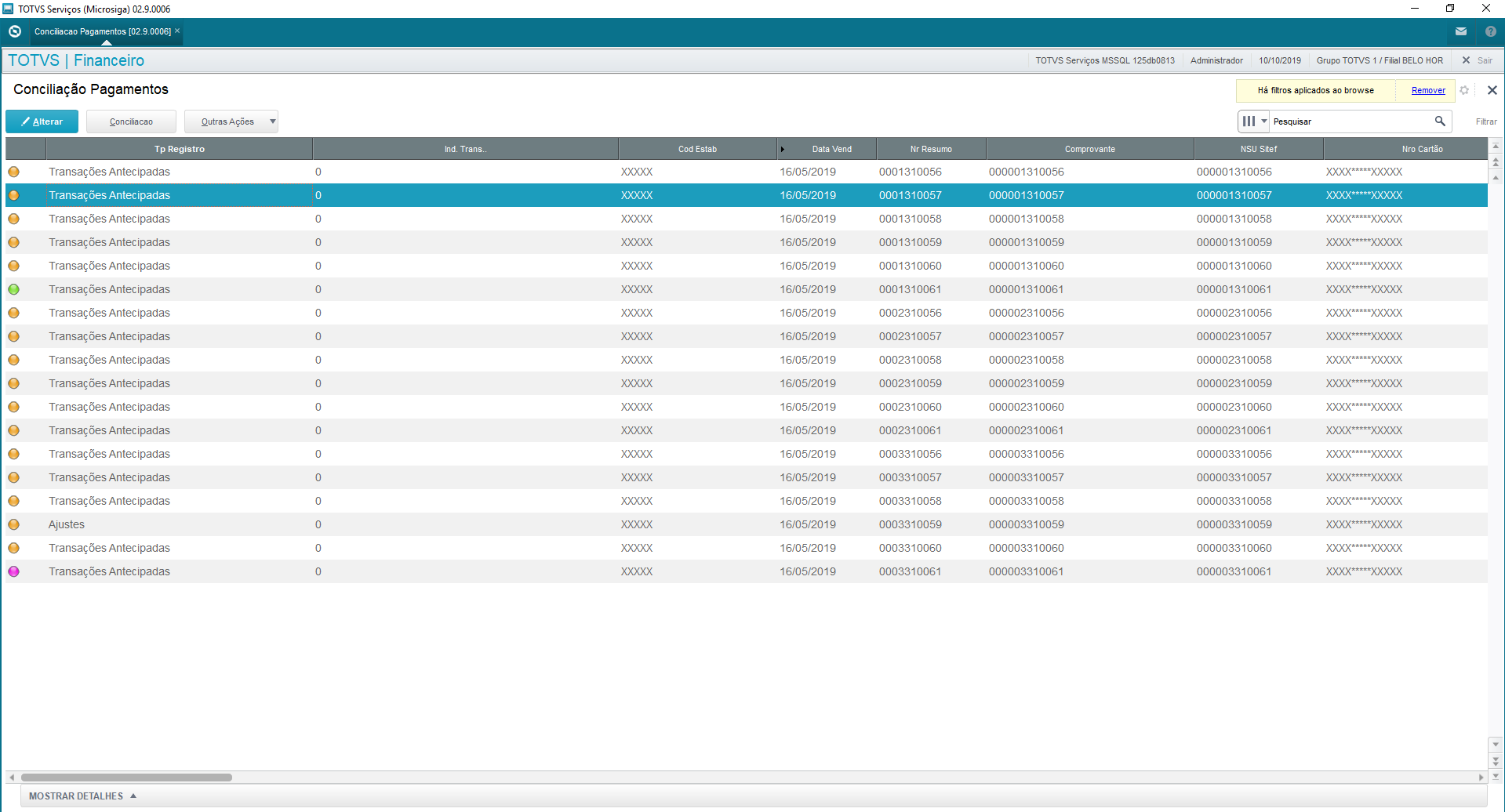

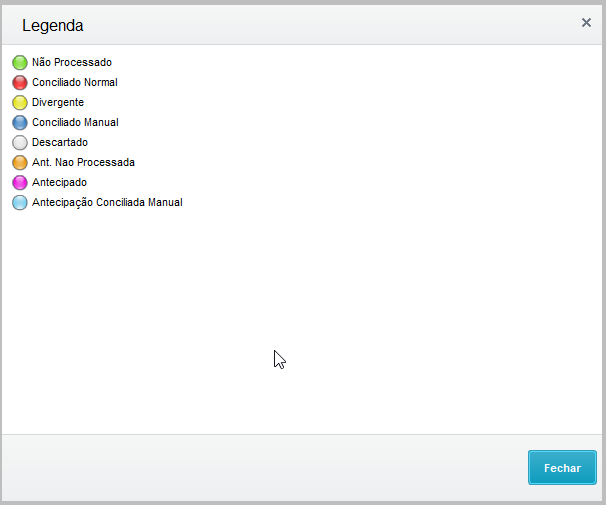

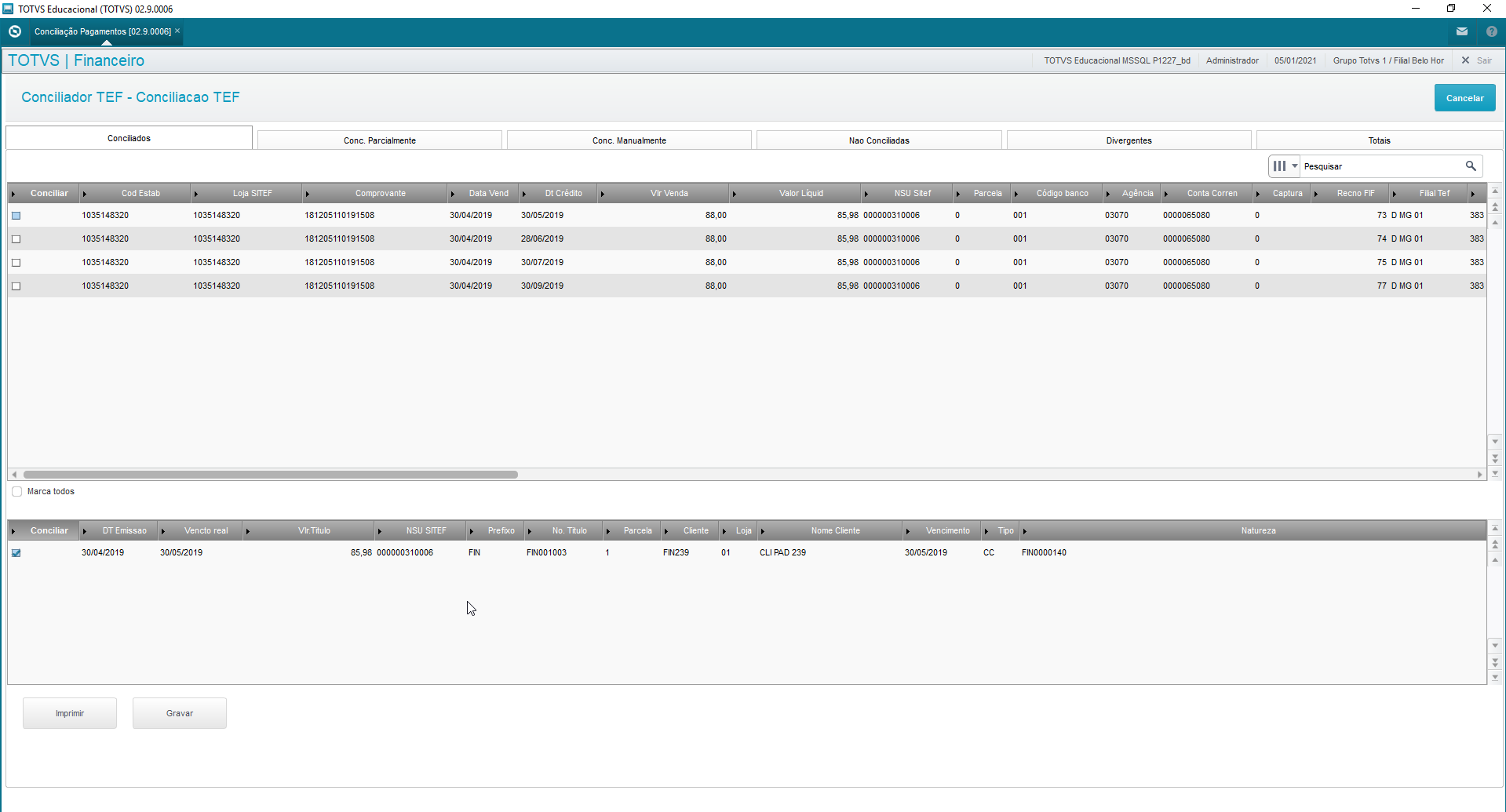

Main browser displays all sales/payment records this routine has imported and enabled. From this browser the reconciliation process begins. The process reconciles payments, which are records from file imports of the card issuers: CIELO, REDECARD, AMEX and from the Card Company SOFTWARE EXPRESS, with financial records of accounts receivable, which had as payment methods: credit or debit card. When a payment is reconciled, the bill is posted and its value enters the bank transactions. Caption:

Captions are updated in accordance with user actions and the comparative results between Protheus and files from the issuers: CIELO, REDECARD, AMEX and from the Credit Card Company SOFTWARE EXPRESS

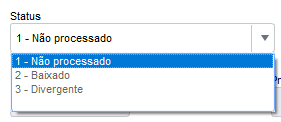

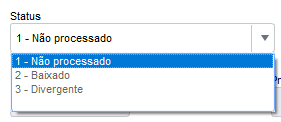

When files are imported, all records start with "Not Processed", changing status as information is processed. Edit If needed, you can edit the "status" field of a sales bill. The statuses you can change are:

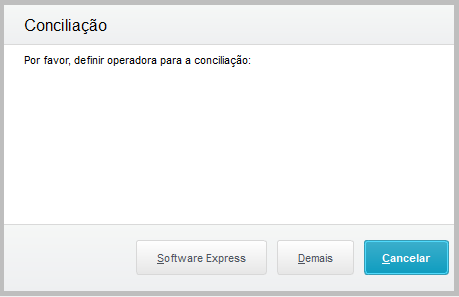

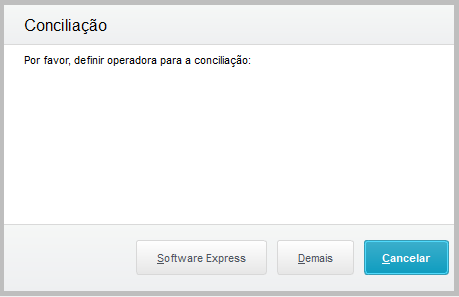

Posted: This status occurs when payments are reconciled, because this process posts the bills. Divergent: This status occurs when there are full returns, partial returns, charge back or modality changes. Not Processed: This status occurs when bills are not reconciled. It must be emphasized that status adjustments do not reverse bill postings. Reconciliation When you select option reconcile, we have this parameters screen: Software Express or Others:

Software Express: reconciliation of sales from the Layout of Software Express. Others: reconciliation of sales from the Layout Others, which are: Cielo, Rede and Amex. These options differ in the selection of Card Issuer x Card Company. For Software Express, you can select various card companies, whereas Others offers only the Cielo, Rede and Amex options. After selection, a screen is displayed with parameters you can fill out: | Totvs custom tabs box |

|---|

| tabs | Software Express, Others |

|---|

| ids | SoftExpress,Others |

|---|

| | Totvs custom tabs box items |

|---|

| default | yes |

|---|

| referencia | SoftExpress |

|---|

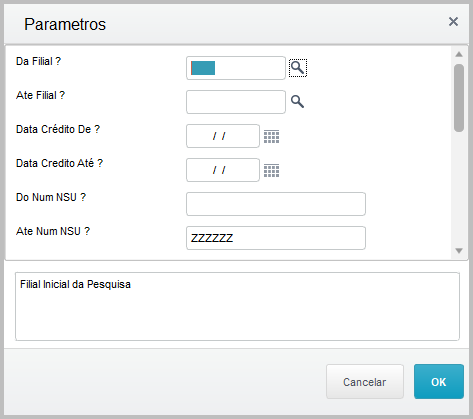

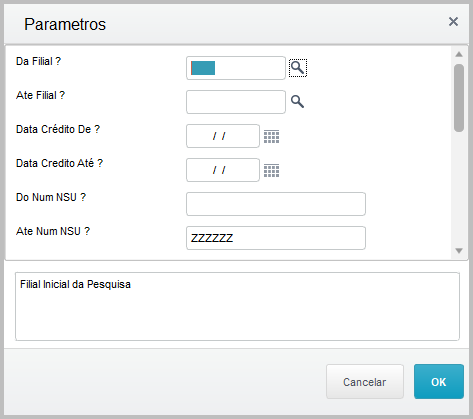

| From Branch? : Initial branch to search sales. To Branch? : Final branch to search sales. From Credit Date: Start Date of sale reconciliation. (evaluate the issue date of sale). To Credit Date: End Date of sale reconciliation. (evaluate the issue date of sale). From NSU No?: NSU Number (Single Sequential Number) that starts the sale reconciliation. (with zeros to the left). To NSU No.?: NSU Number (Single Sequential Number) that ends the sale reconciliation. (with zeros to the left).

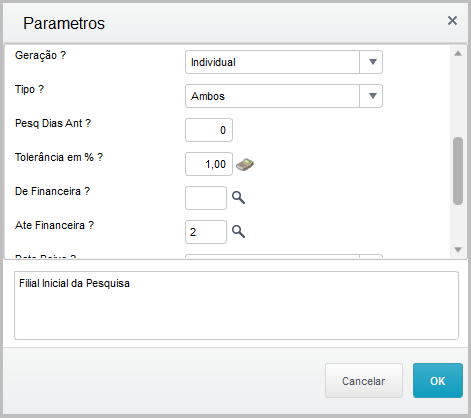

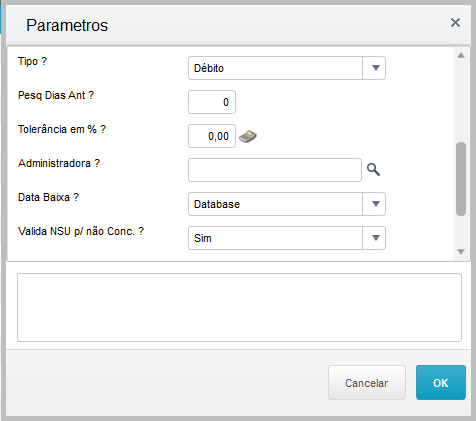

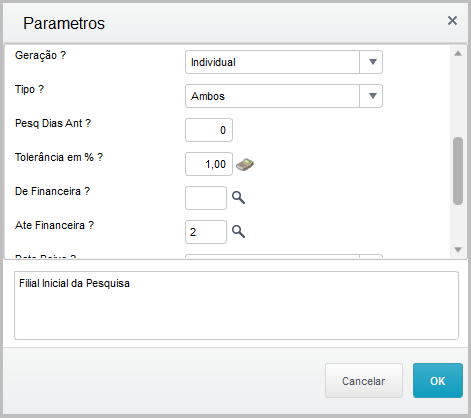

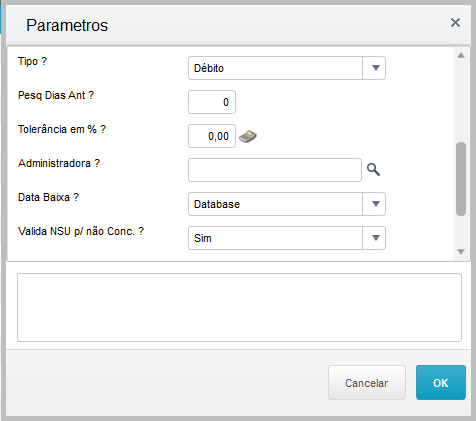

Generation?: Individual - Manually posts bill by bill. By Batch - Automatically posts by batch of bills. Type?: Select the type to be reconciled. Options: Debit/Credit or Both. Search Prev Days?: Subtract days from start of selected search. Example: Credit Date 8/20/2018 with this option equal to 2, sales are selected from 8/18/2018. Tolerance in %?: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system From Financial Company?: Code of initial financial company for the filter. To Financial Company?: Code of final financial company for the filter.

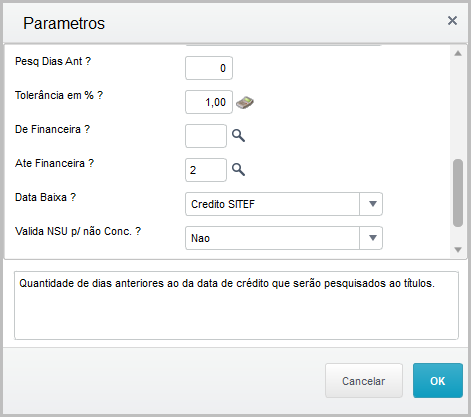

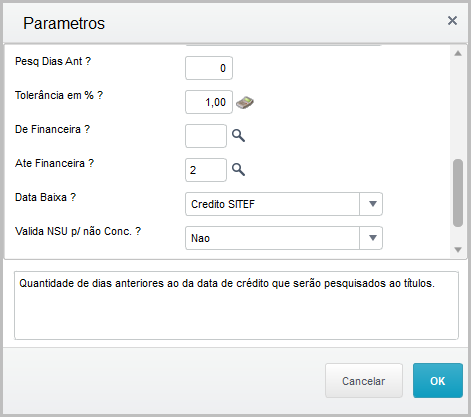

Posting Date?: Set the date of bill posting. Base Date - day of reconciliation execution and SITEF Credit - Credit date sent in file. Validate NSU f/ Not Rec.?: Validate in tab "Not Reconciled" whether the relationship between a sale and a bill in financials must have the same NSU.

|

| Totvs custom tabs box items |

|---|

| default | no |

|---|

| referencia | Others |

|---|

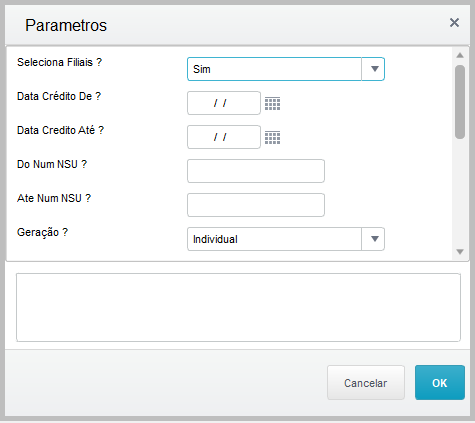

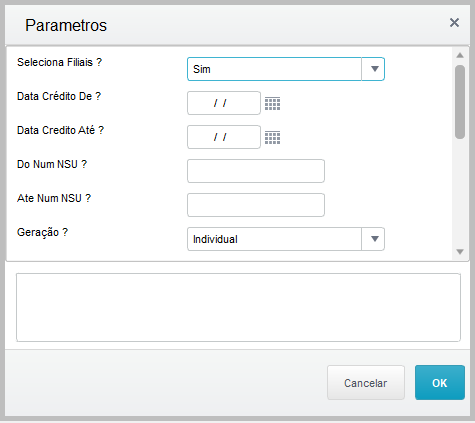

| Select Branches: You can select one or more branches. The field is multiple choice for reconciliation of multiple branches. From Credit Date: Start Date of sale reconciliation. (evaluate the issue date of sale) To Credit Date: End Date of sale reconciliation. (evaluate the issue date of sale) From NSU No?: NSU Number (Single Sequential Number) that starts the sale reconciliation. (with zeros to the left) To NSU No.?: NSU Number (Single Sequential Number) that ends the sale reconciliation. (with zeros to the left) Generation?: Individual - Manually posts bill by bill. By Batch - Automatically posts by batch of bills.

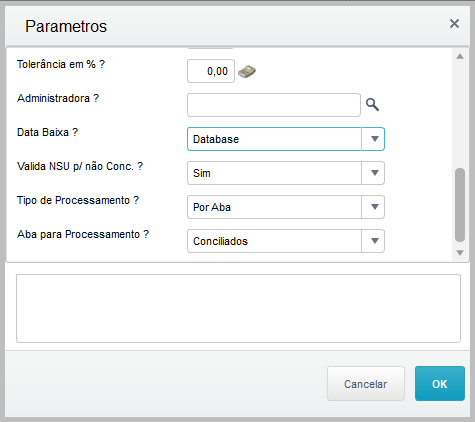

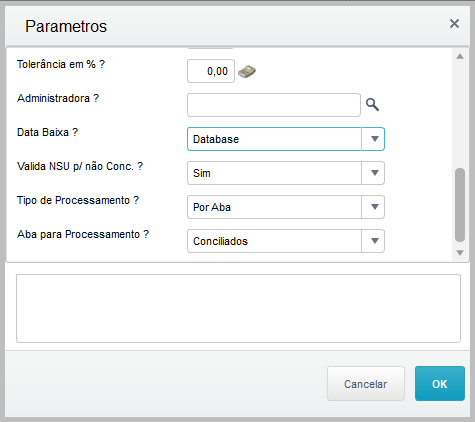

Type: Select the type to be reconciled. Options: Debit/Credit or Both. Search Prev Days?: Subtract days from start of selected search. Example: Credit Date 8/20/2018 with this option equal to 2, sales are selected from 8/18/2018. Tolerance in %: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system Card Company: Click the "magnifying glass" icon to display card companies. You may select one or more card companies to reconcile sales. Posting Date? : Set the date of bill posting. Base Date - day of reconciliation execution and SITEF Credit - Credit date sent in file. Validate NSU f/ Not Rec.? : Validate in tab "Not Reconciled" whether the relationship between a sale and a bill in financials must have the same NSU.

Processing Type?: Option created for you to choose the data processing type (by tab → display records of tab selected only) or (General → display records of all tabs) Tab for Processing?: Tab to be used along with previous parameter. (1-Reconciled / 2-Partially Reconciled / 3-Bills Without Sales / 4-Sales Without Bills / 5-Divergent)

|

|

| Totvs custom tabs box |

|---|

| tabs | Reconciled, Partially Reconciled, Manually Reconciled, Not Reconciled, Divergent, Totals |

|---|

| ids | PConc,PNConc,PConcManual,PNaoConc,PDiv,PTot |

|---|

| | Totvs custom tabs box items |

|---|

| default | yes |

|---|

| referencia | PConc |

|---|

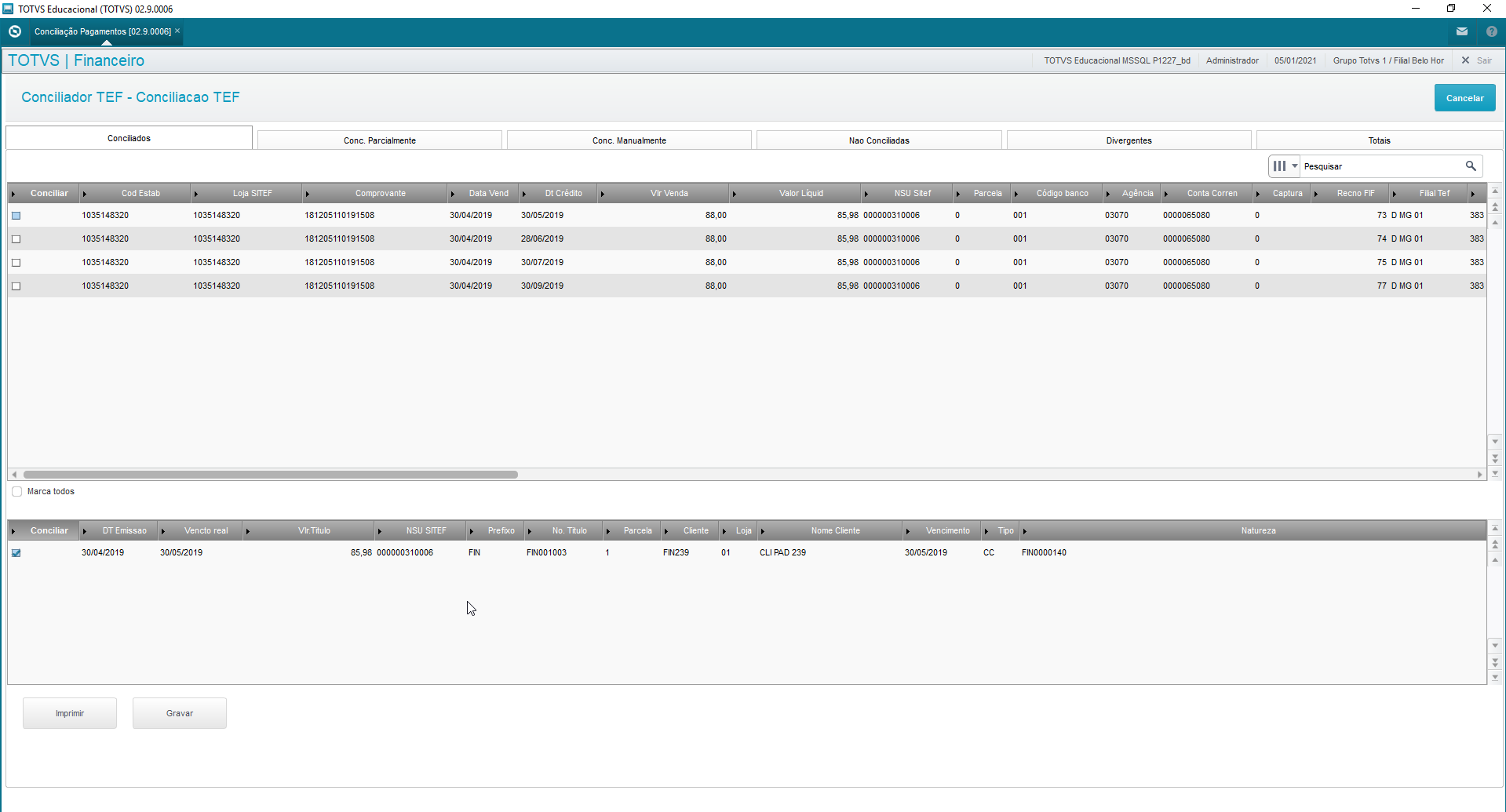

| Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key: Branch, Establishment, NSU, installment, issue date, authorization code, type (Debit/Credit) and tolerance percentage (the tolerance percentage is set in routine parameters). Tolerance Percentage: Consider that the net sale value must be greater than or equal to the bill balance minus the specified percentage. Example: Sale Sale (file) | Bill (Protheus) | Gross Value BRL 200.00 | Value BRL 195.00 | Net Value BRL 198.00 | Balance BRL 195.00 | Tolerance percentage 10% |

|

Use the following calculation to define whether to fully reconcile it. Net Value >= Balance - ( Balance * Percentage) 198 >= 195 - (195 * 10%) 198 >= 195 - 19.5 198 >= 175.5

The grid above shows sales, imported through the issuer file, already related with bills found in the system. The records already become fit to be reconciled through button "Activate Reconciliation". Reset item selections by clicking item by item. Print: To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later. Save:When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted. |

| Totvs custom tabs box items |

|---|

| default | no |

|---|

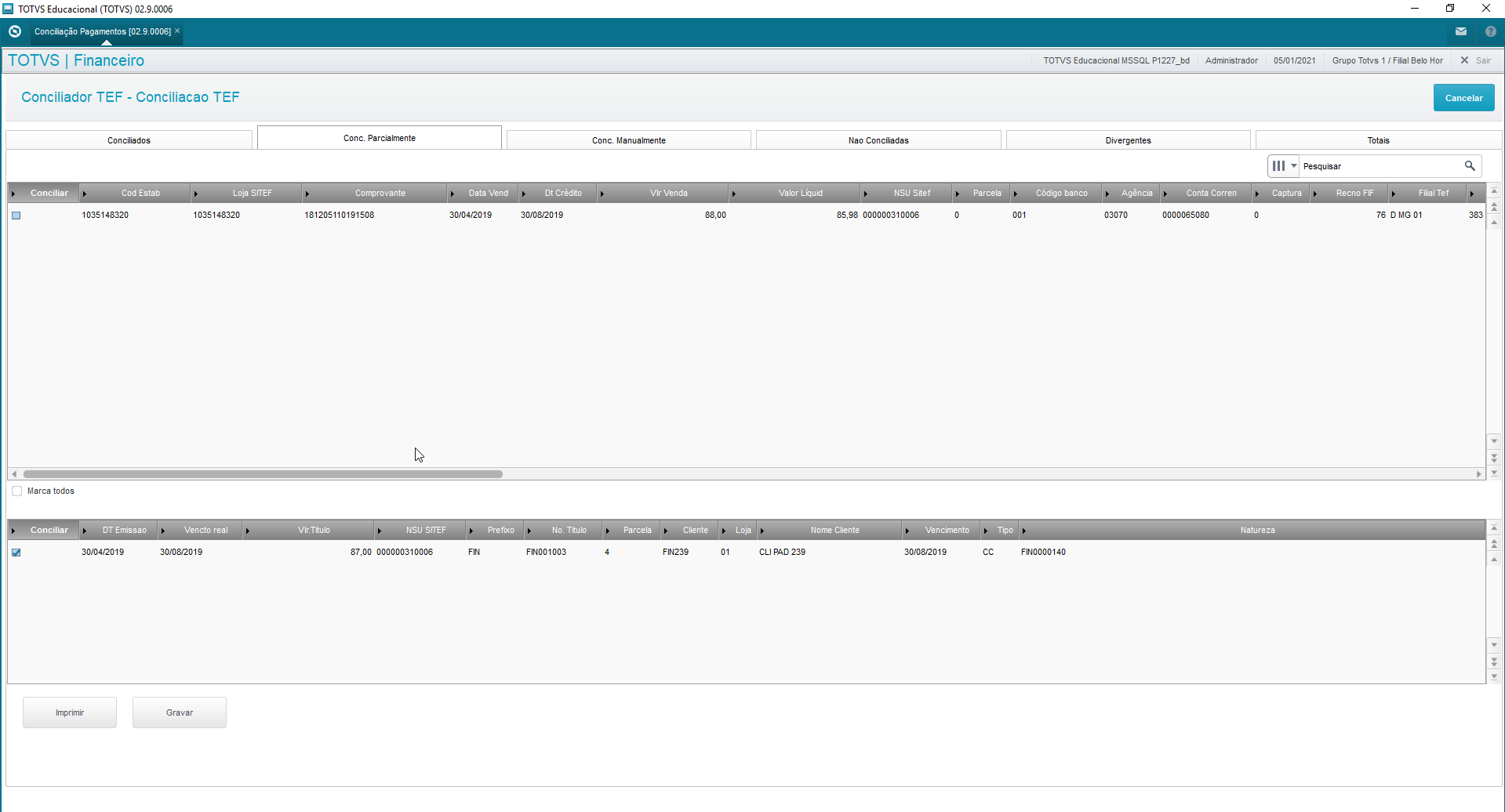

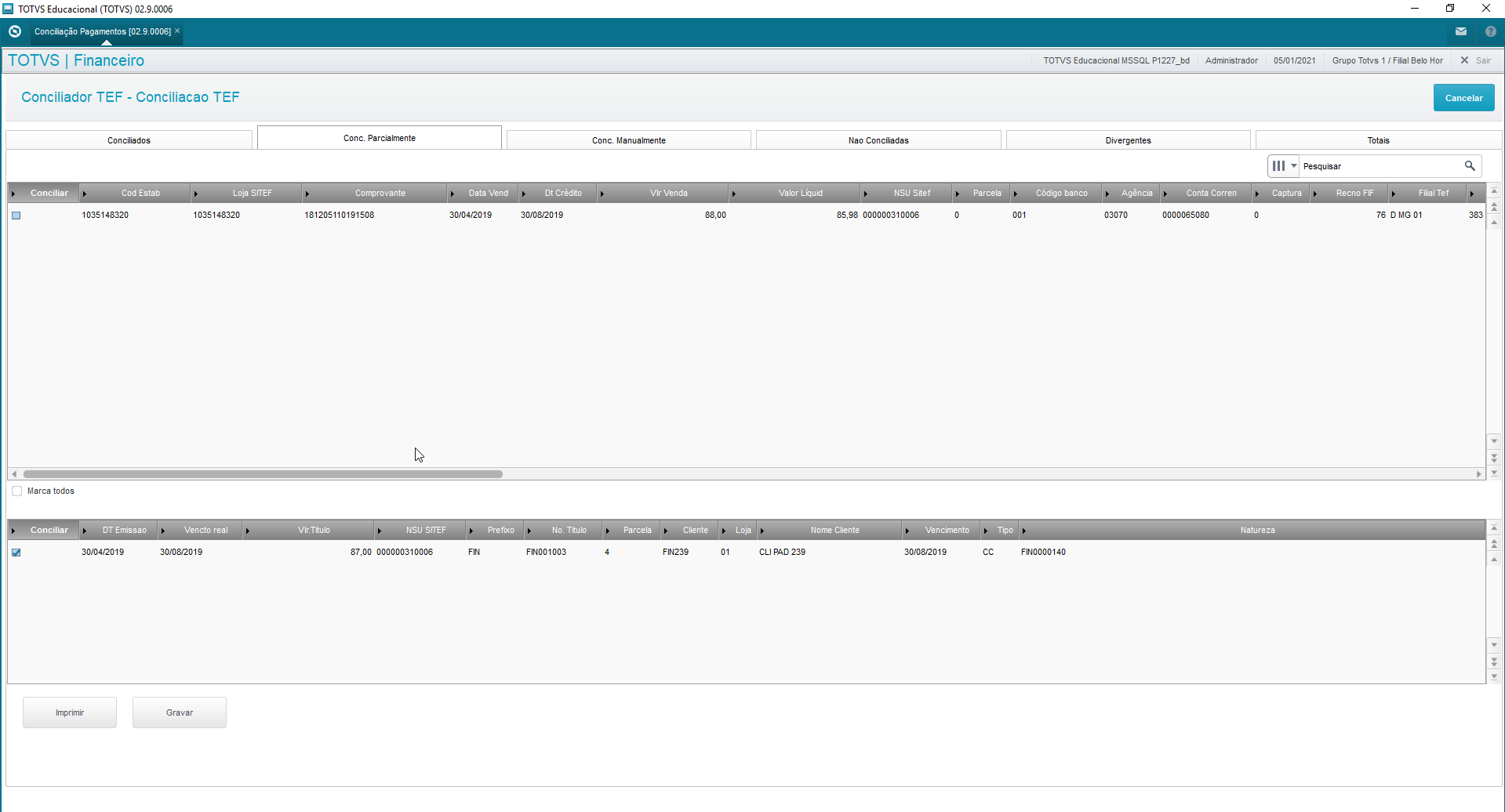

| referencia | PNConc |

|---|

| Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key, Branch, Establishment, NSU, installment, issue date, type (Debit/Credit) although "outside" the set tolerance percentage. Tolerance Percentage: Consider that the net sale value must be smaller than the bill balance minus the specified percentage. Example: Sale Sale (file) | Bill (Protheus) | Gross Value BRL 200.00 | Value BRL 225.00 | Net Value BRL 198.00 | Balance BRL 225.00 | Tolerance percentage 10% |

|

Use the following calculation to define whether to fully reconcile it: Net Value >= Balance - ( Balance * Percentage) 198 < 225 - (225 * 10%) 198 < 225 - 22.5 198 < 202.5

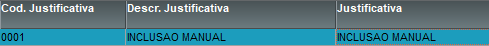

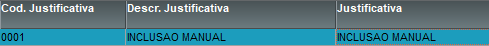

The upper grid shows sales imported through the file from the card issuer and card companies, whereas the lower grid shows data from the bill found in the system. The records already appear selected to make the reconciliation effective. You can select item by item or use option "Select All" to change the current selection. Print:To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later. Save:To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted. Save justification data of said reconciliation, considering it was made outside regular parameters. |

| Totvs custom tabs box items |

|---|

| default | no |

|---|

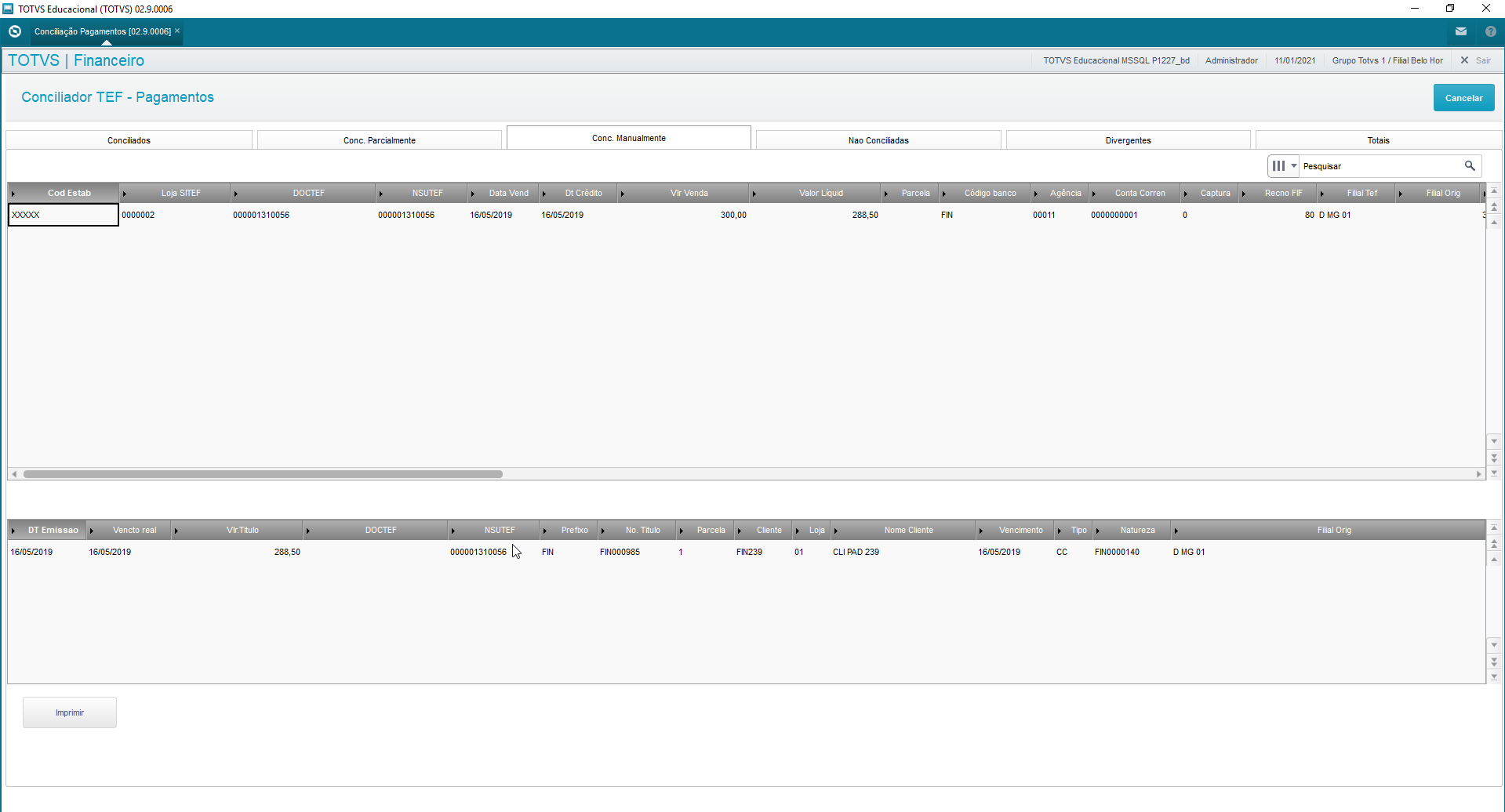

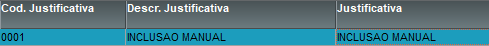

| referencia | PConcManual |

|---|

| Tab "Manually Reconciled" displays bills made effective in tab "Not Reconciled", because in tab not reconciled bills are made effective with justifications and, once confirmed, this record is transferred to tab manually reconciled.

The grid displays sales made effective in tab not reconciled with justifications entered by the operator. This tab displays data in execution time onscreen, that is, it always starts empty, being filled as the manual reconciliations occur. Print: Print the grid in Excel format to analyze the data or to check it later. |

| Totvs custom tabs box items |

|---|

| default | no |

|---|

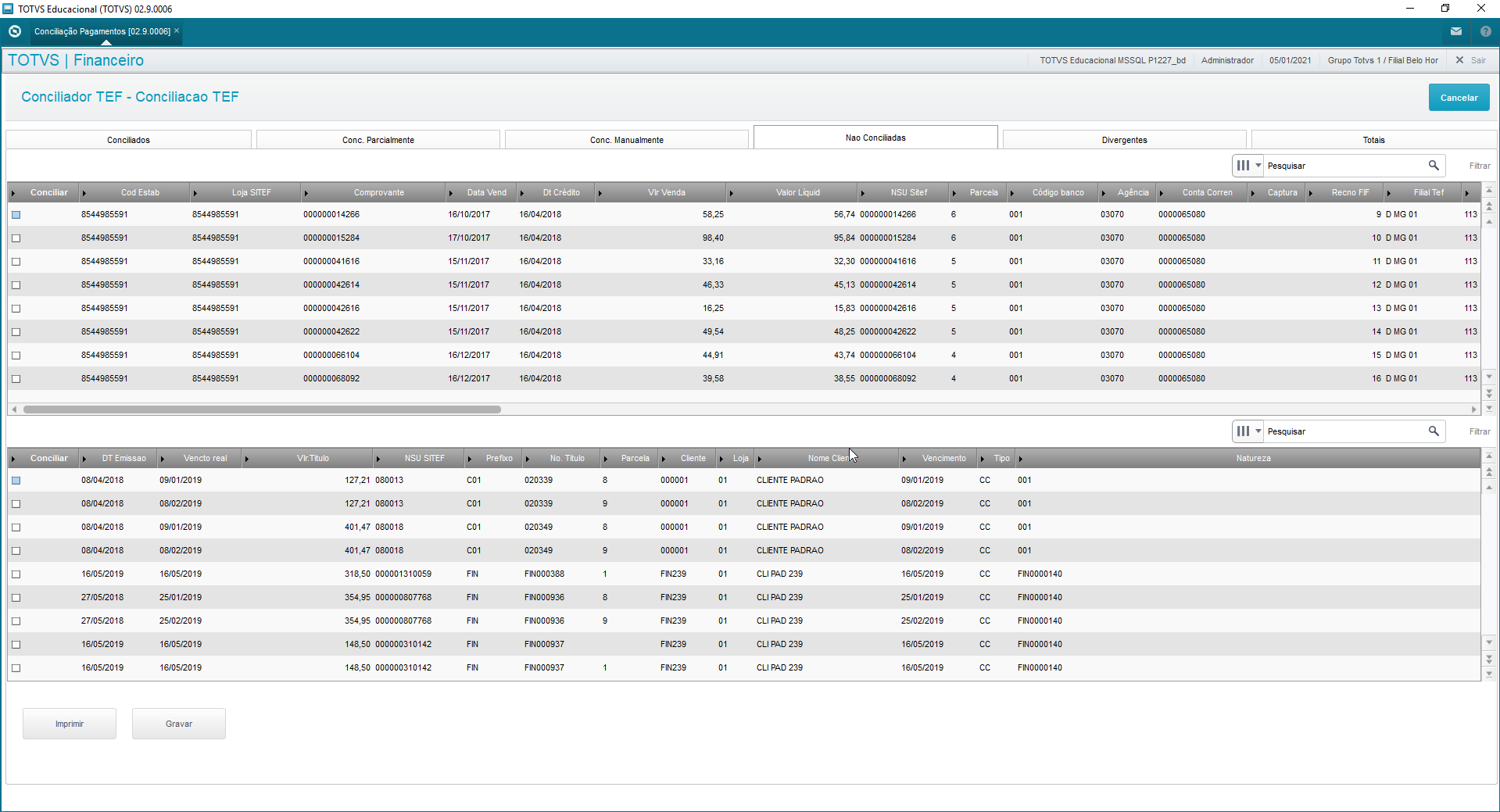

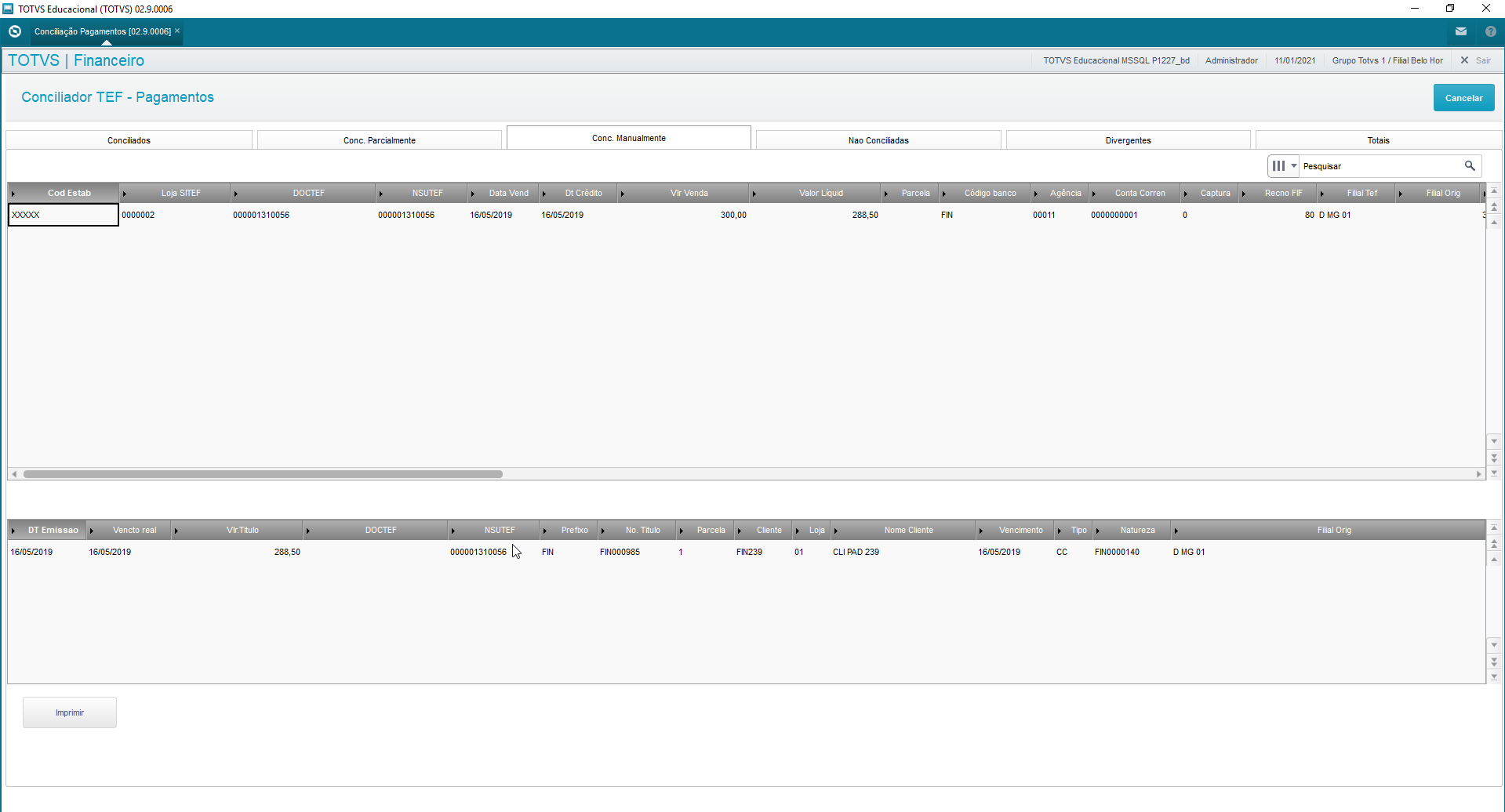

| referencia | PNaoConc |

|---|

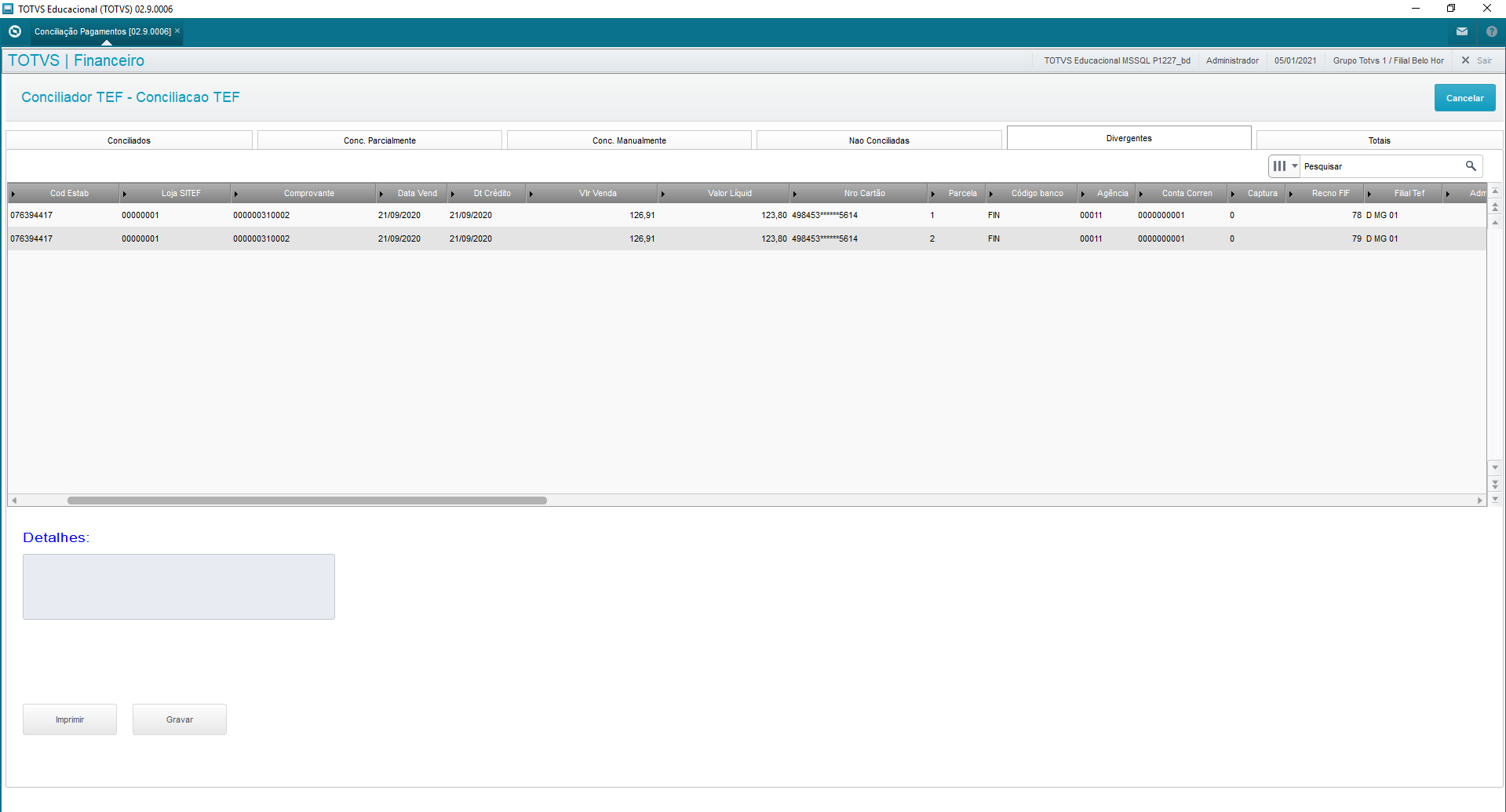

| Correspond to sales imported from the issuer files the counterparts of which (financial bills in Protheus) were not found in the Protheus database, enabling manual reconciliation with bills available in the database.

The upper grid shows sales imported through the issuer files that were not reconciled. The lower grid shows all bills in the database fit for reconciliation with sales from SIGALOJA. If the question at start is Validate NSU f/ Not Rec.?: Is set to YES, the relationship is only allowed if NSU is the same between bill and sale, otherwise the relationship between sale and bill is possible. Print: To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later. Save:To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted. Save justification data of said reconciliation, considering it was made outside regular parameters. |

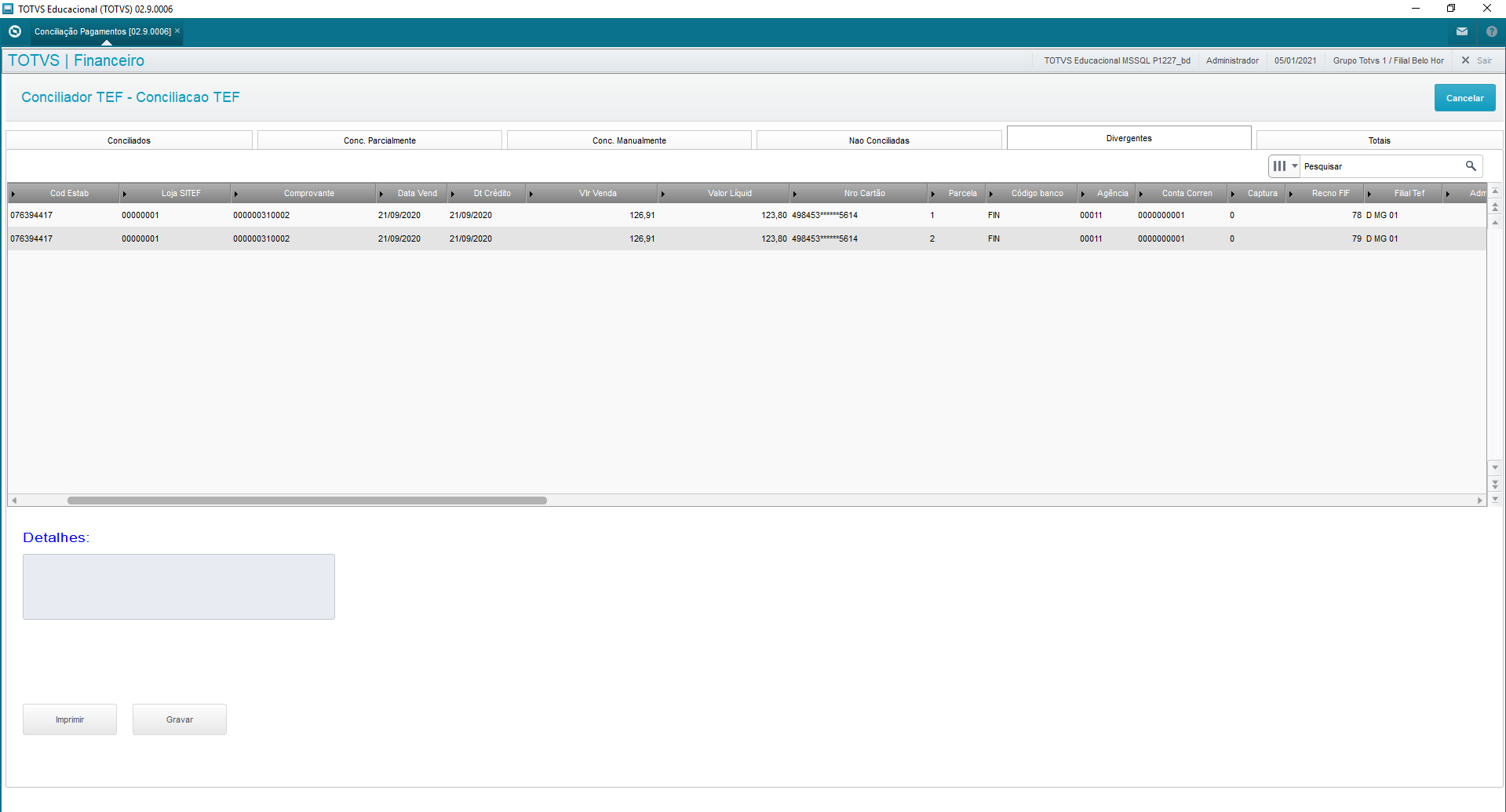

| Totvs custom tabs box items |

|---|

| Divergent: contains all sales entered in the card company file with some kind of occurrence, such as: Total Refund, Partial Refund, Charge Back, Modality Change.

Print: Print the grid in Excel format to analyze the data or to check it later. Save:To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

Enter type of reconciliation made and save the justification data of said reconciliation, considering it was made outside regular parameters. This update ensures this record is no longer displayed in future reconciliations. |

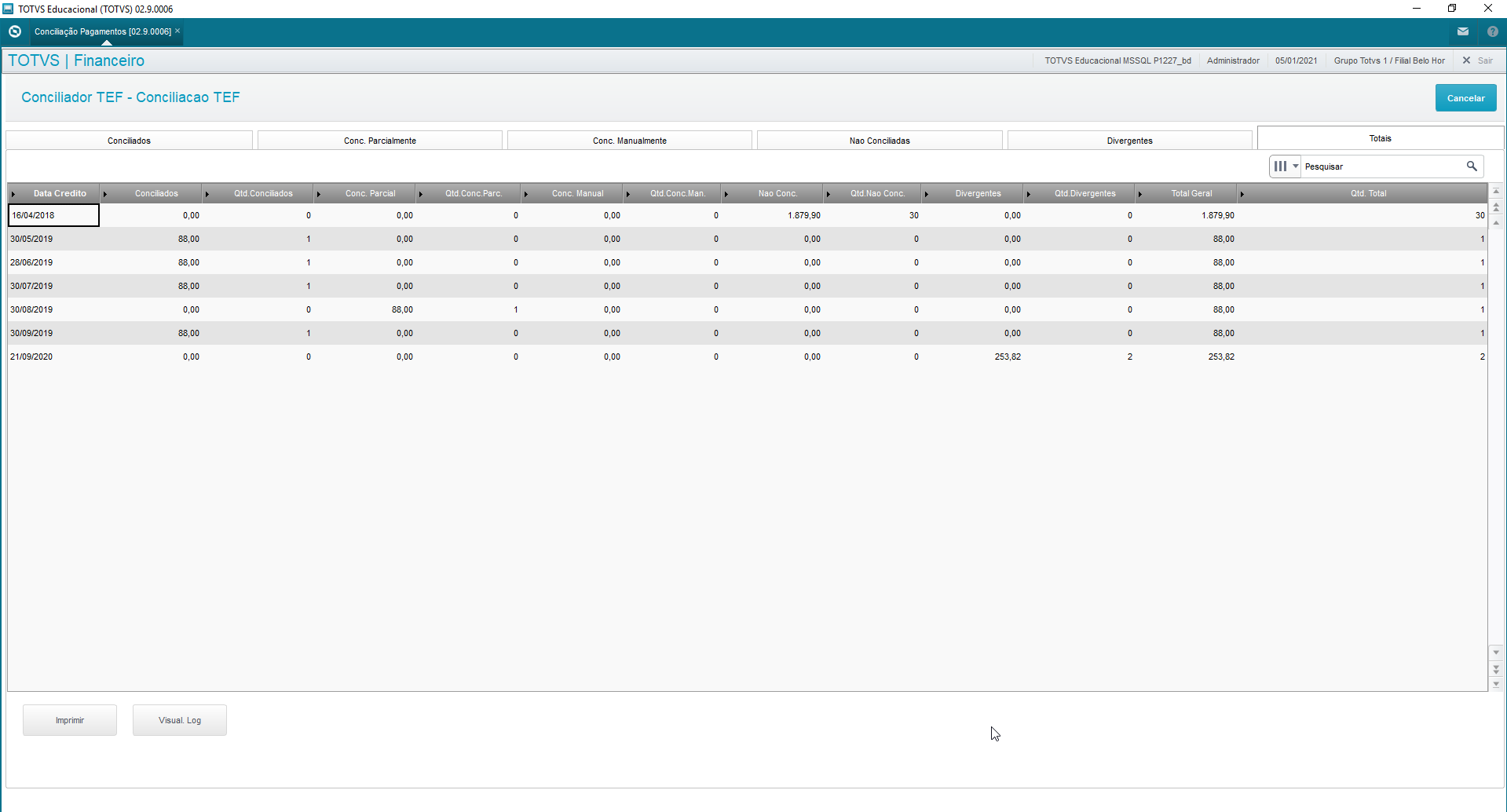

| Totvs custom tabs box items |

|---|

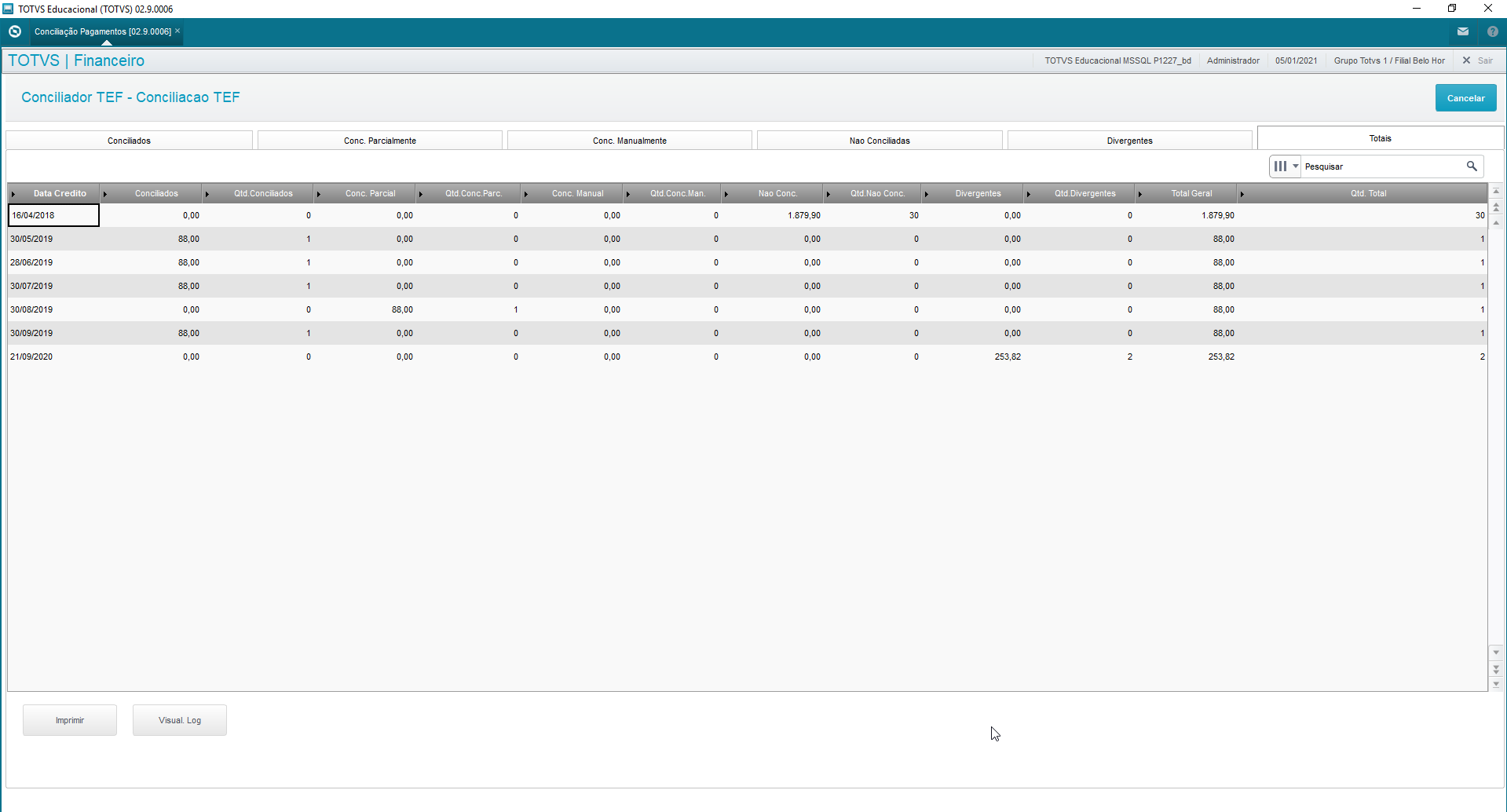

| Totals: display quantity of records with gross and net values in BRL by date for each tab.

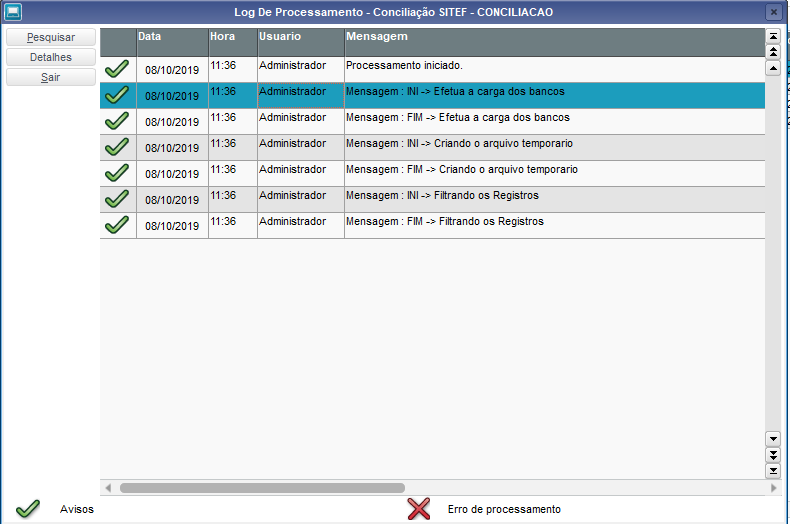

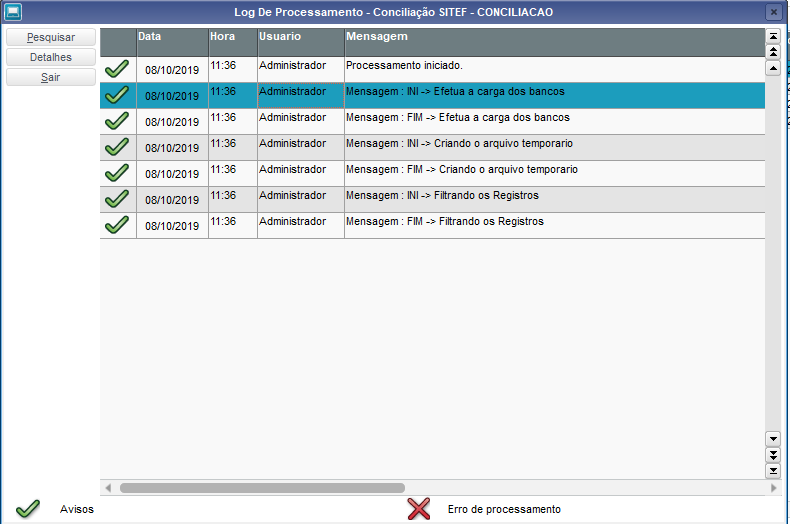

Print: Print the grid in Excel format to analyze the data or to check it later. View Log: Use option "View Log" to evaluate who executed the payment reconciliation routine. Find the name of the user who executed the process in column "User".

|

|

|