01. Visão Geral

O Índice de Participação por Município (IPM) é um controle efetuado pelas Secretarias da Fazenda Estadual (SEFAZ) para identificar o montante de operações realizadas em cada município,

com o propósito de realizar uma melhor distribuição do imposto recolhido para os municípios de seu território. Essas informações são apresentadas no registro 1400 da EFD ICMS/IPI.

Essa funcionalidade permite rastrear quais os valores divididos para cada município e identificar (via relatório) como o sistema chegou nesses valores, trazendo informações dos documentos fiscais e das regras utilizadas.

O objetivo da rotina de apuração é que seja personalizável, permitindo que o cliente consiga configurar e montar as regras de geração do registro 1400 de acordo com sua movimentação.

02. Pré-Condições

2.0 Código de item para IPM ( CLN )

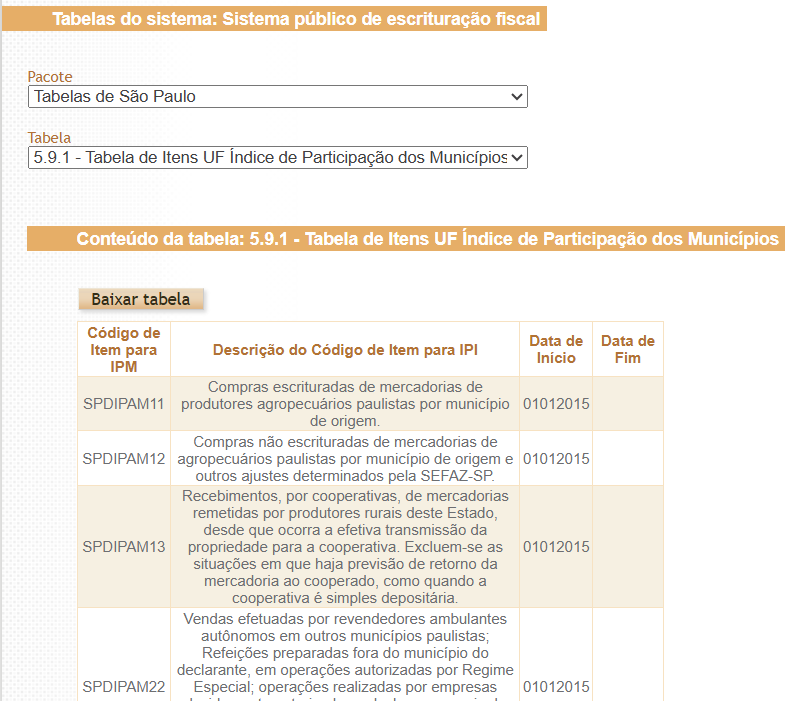

Realize a importação dos códigos de IPM por UF na rotina Tabela de IPM (FISA094)

Tabelas do sistema: Sistema público de escrituração fiscal

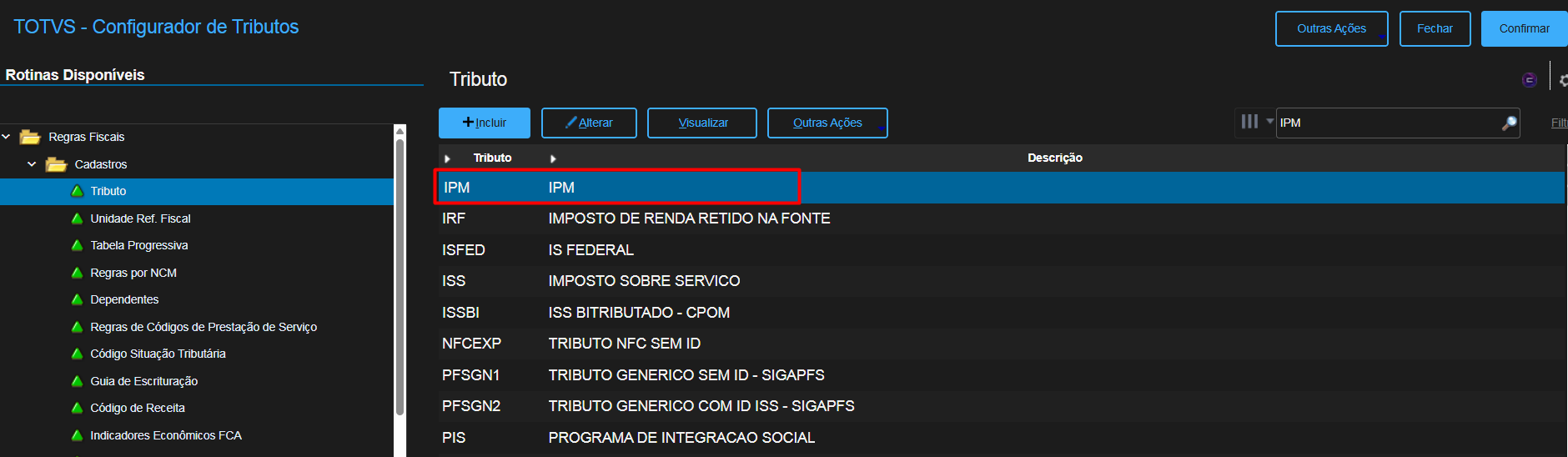

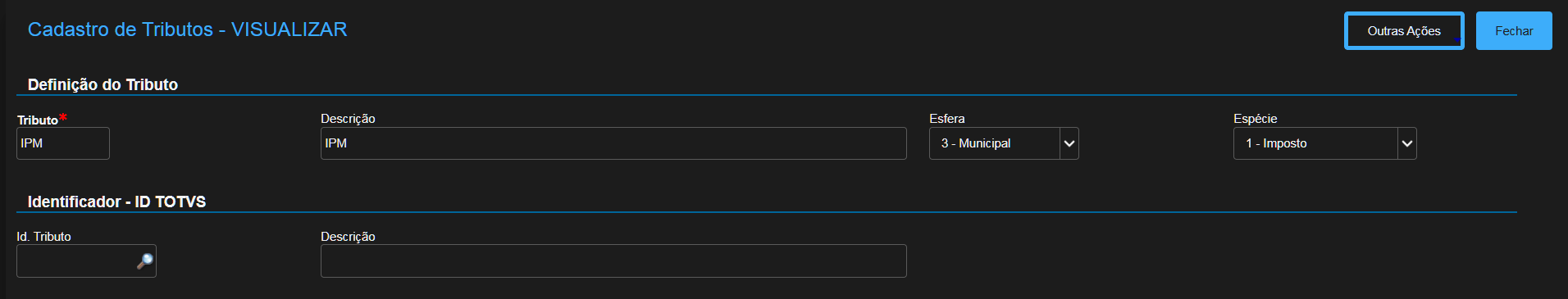

2.1 Criação do Tributo Genérico

Inclua no configurador de tributos o tributo que será utilizado para identificar as operações a serem consideradas na apuração do IPM. No exemplo, utilizamos a nomenclatura IPM

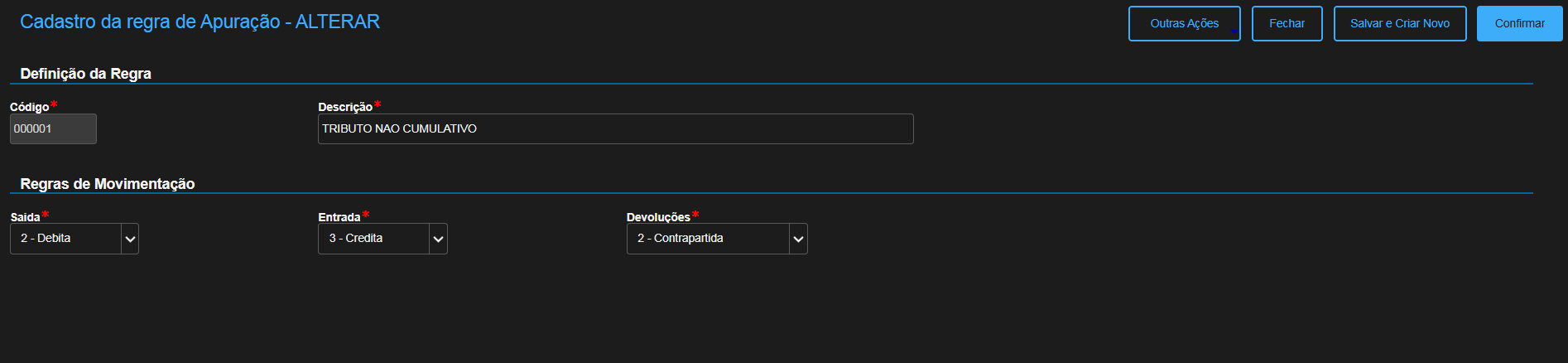

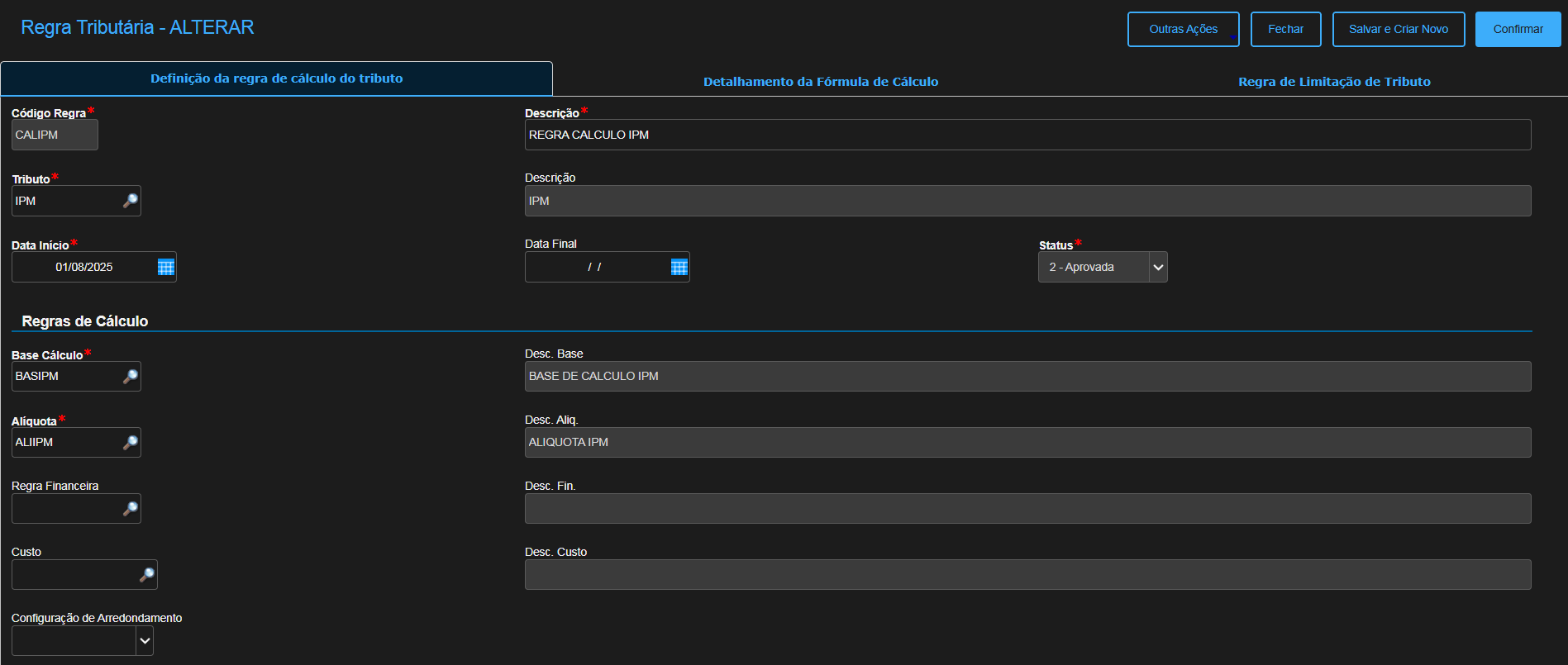

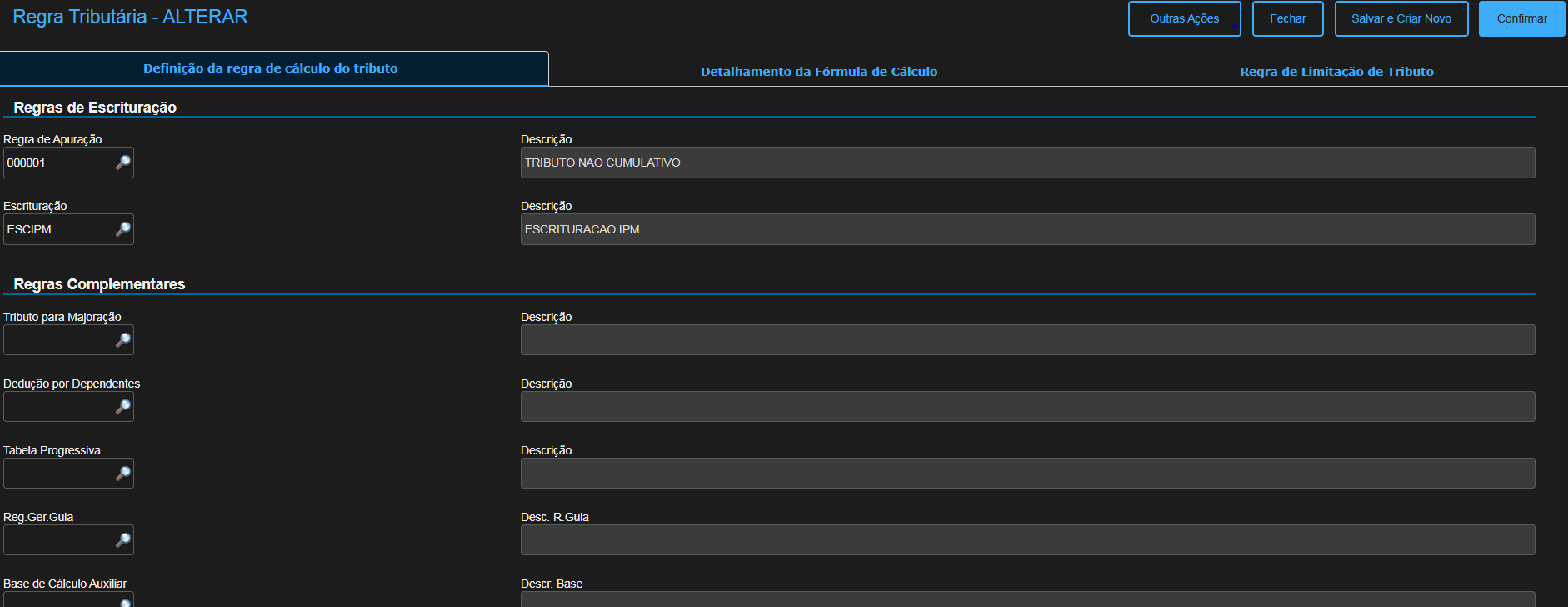

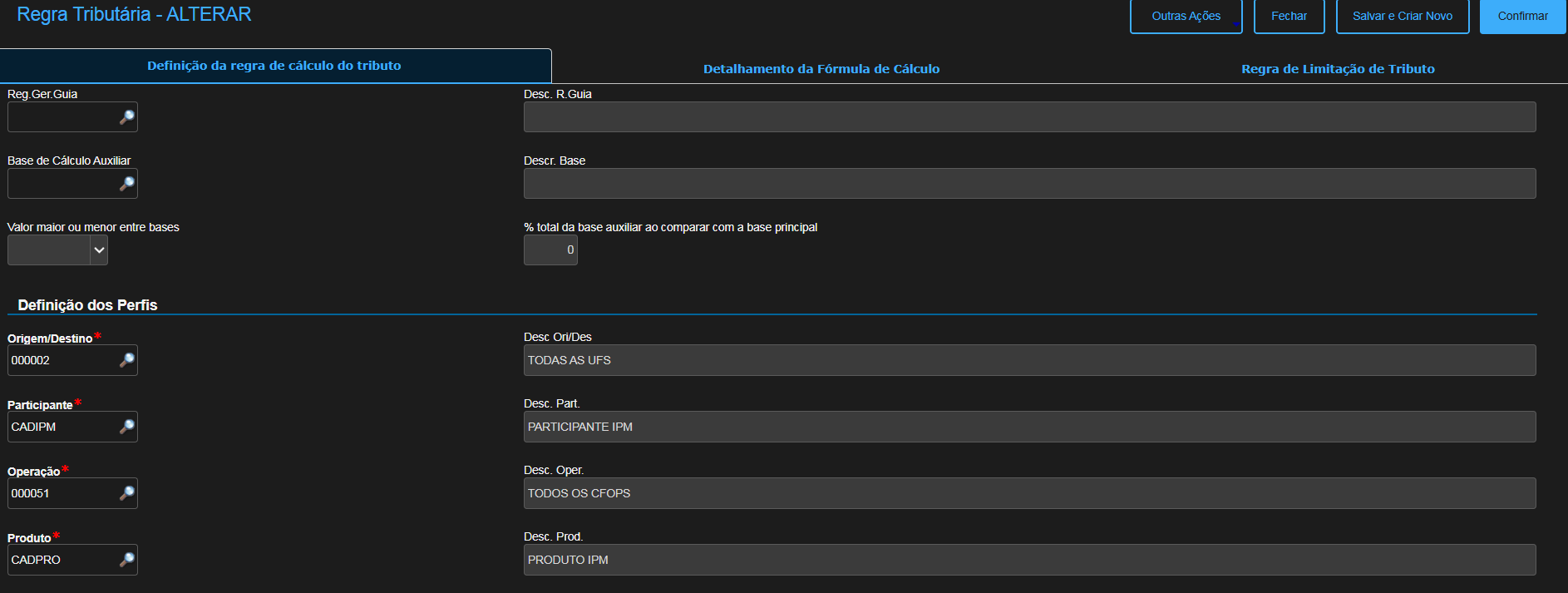

2.2 Criação de Perfis e Regras

Previamente, devemos incluir os perfis de produto, operação, participante e origem/destino, para posterior vínculo à regra de cálculo.

Além disso, é necessário cadastrar as regras de base de cálculo, alíquota, escrituração e apuração.

No cadastro da regra de apuração, serão definidas as operações de crédito e débito.

Após o cadastro de todos os perfis e regras, devemos vincular a Regra de Cálculo - Documentos Fiscais.

Para mais informações sobre o configurador de tributo acesse: Configurador de Tributos.

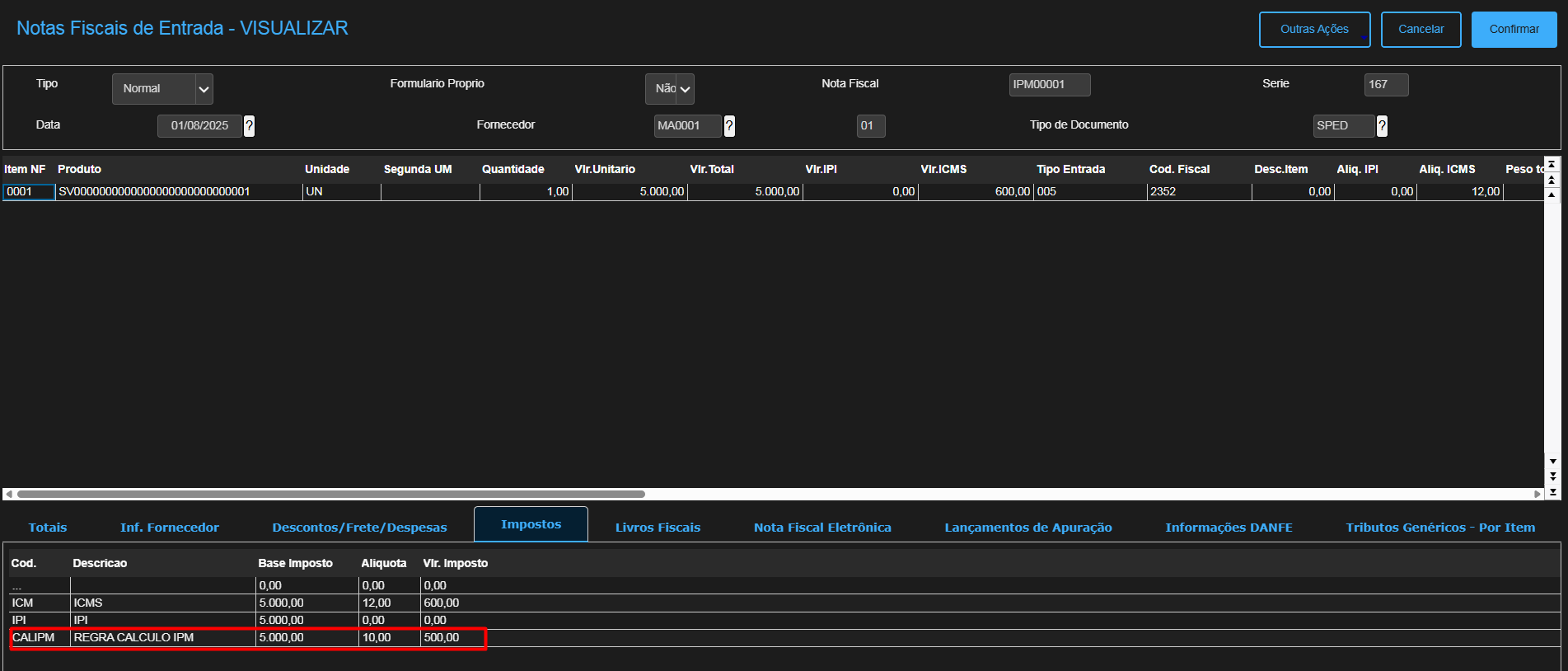

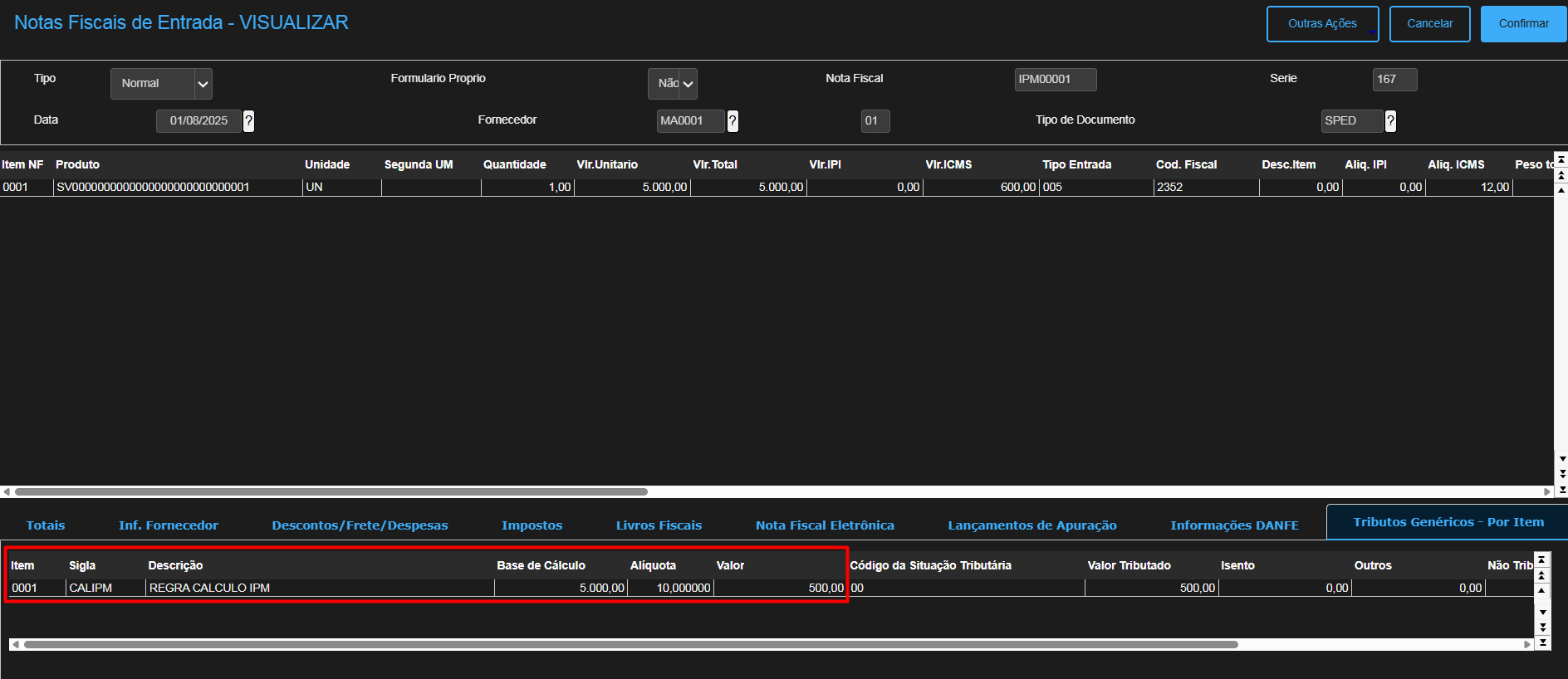

2.2 Cálculo do Tributo IPM

Após realizar os cadastros anteriores, realize a inclusão de um documento de entrada/saída. Deverá ser apresentado na aba Impostos o código da regra de cálculo.

Na aba Tributos Genéricos - Por Item, serão apresentados os itens que tiveram o tributo de IPM.

03. Apuração

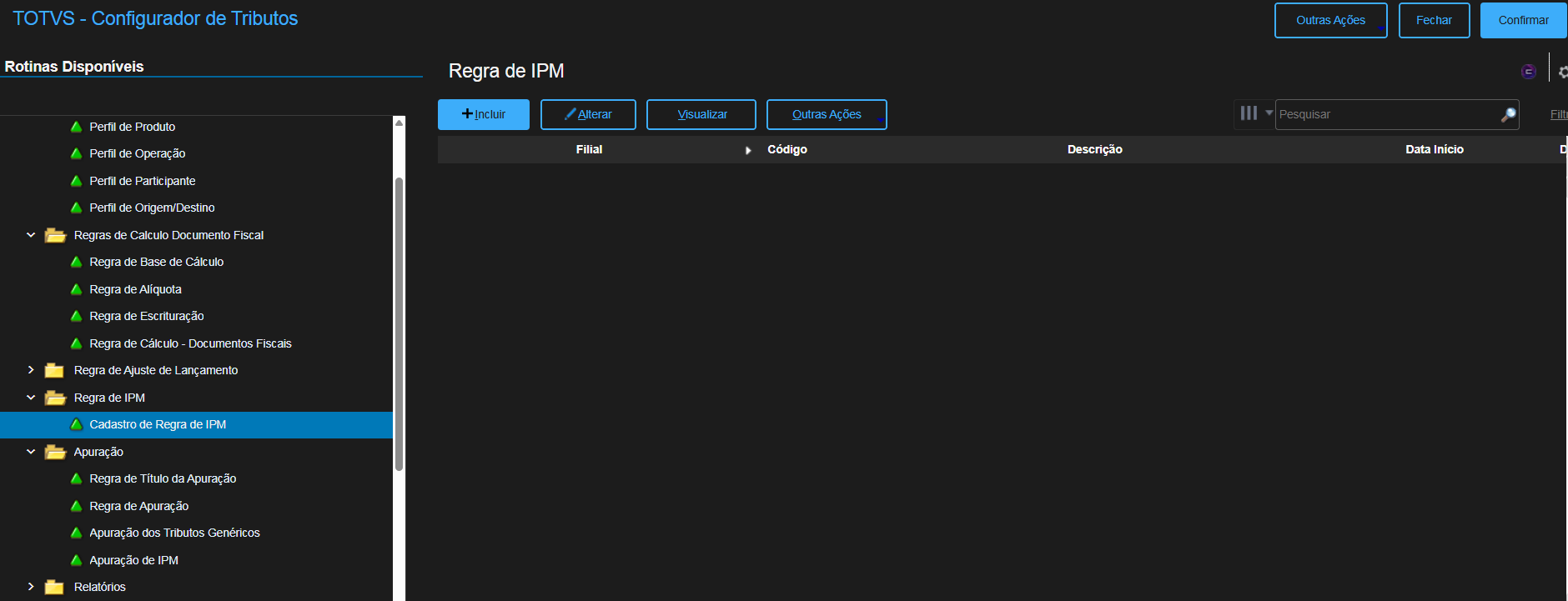

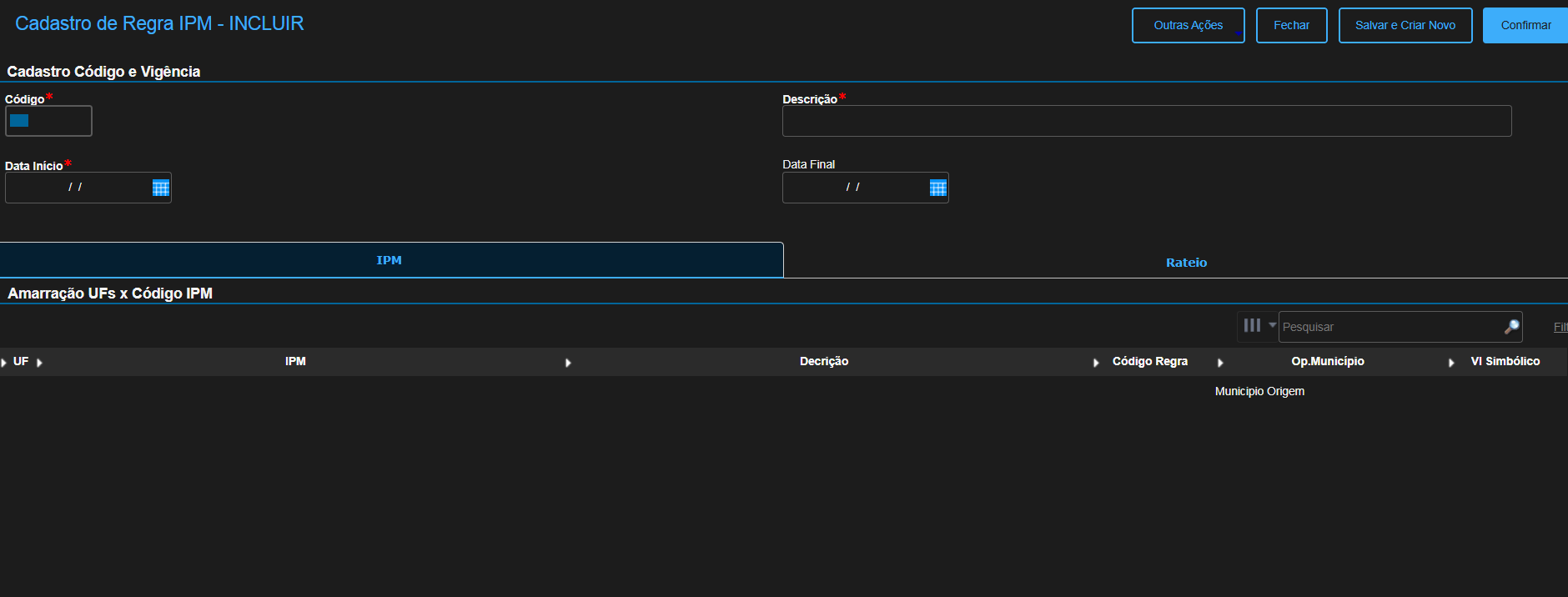

3.1 Definição de Regra de Apuração IPM

Através desta rotina é possível cadastrar uma regra de apuração de IPM. No momento da apuração do tributo esta regra será interpretada.

No cadastro deverá ser criado um código, descrição, início e fim de vigência da regra.

Na Aba IPM, deve ser preenchido:

UF: Informe a UF que deseja utilizar na regra de cálculo do IPM, pode cadastrar mais de uma UF em um único cadastro.

IPM: Informe o código da DIPAM que foi importado na rotina (FISA094).

Descrição: Descrição do código da DIPAM

Código Regra: Escolha o código de regra que foi cadastrado na Regra de Cálculo - Documentos Fiscais

Op. Município:

1- Município Origem: será usado o parâmetro MV_ESTADO para filtrar a origem nos campos F1_UFORITR, F2_UFORIG e DUY_EST;

2- Município Destino: será usado o parâmetro MV_ESTADO para filtrar o destino nos campos F1_UFDESTR, F2_UFDEST e DUY_EST;

3- Município Participante: será usado o parâmetro MV_ESTADO para filtrar os campos A1_EST e A2_EST do participante;

4- Município Contribuinte: irá extrair todas as notas que tiveram cálculo da regra de IPM, por UF - IPM, e vincular no município do contribuinte - M0_CODMUN;

5- Rateio: irá extrair toda as notas que tiveram cálculo da regra de IPM e ratear pelos munícipios configurados.

Obs.: Caso possua a UF - DIPAM com regras diferentes e em alguma delas possuir rateio, deverá marcar rateio para todas UF - IPM iguais e o rateio será o mesmo para todas.

Vl. Simbólico: Inclui o valor simbólico de 0,01 quando não houver operações.

Na Aba Rateio, quando selecionado rateio no IPM, deverá preencher os munícipios e os percentuais para cada município, totalizando 100% da distribuição do rateio.

Se houver rateio localizado para a competência na chave do UF + Código IPM, todos os outros lançamentos da CKE para aquela UF + Código IPM deverão ser do tipo rateio.

3.2 Apuração de IPM

Acessar o Configurador de tributos (FISA170) \ Regras Fiscais \ Apuração \ Apuração de IPM ( FISA325 ).

Através desta rotina é possível realizar a apuração de IPM. O valor de débito resultante será utilizado para o envio do bloco 1400 do SPED Fiscal.

Para iniciar o processo de apuração, clique em Processar e selecione a filial onde a apuração será registrada. Essa filial será considerada a filial centralizadora.

Será iniciado um Wizard para a informações dos parâmetros:

- Data Inicial: Data inicial do período;

- Data Final: Data final do período;

- Seleciona Filiais: apurar movimento de várias filiais para consolidar na centralizadora;

- Agrupa CPNJ + IE: apurar movimento de apenas as filiais selecionadas com a mesma CNPJ + IE;

- Tipo Período: Mensal ou Anual, conforme tipo da tabela CLN.

Marque o tributo genérico IPM e clique em avançar. Será realizada a apuração conforme parâmetros e configuração da regra IPM, após finalização será apresentado o painel para visualização dos dados apurados.

Caso precise processar o mesmo período novamente, será apresentada a mensagem informando que apuração atual será excluída e será gerada uma nova apuração para o período.

3.2 Apuração de IPM em 2º Plano

Caso o ambiente esteja configurado com o SMARTSCHEDULE a apuração ocorrerá em segundo plano.

O campo CKG_CONAPU é responsável por controlar o início e o fim da apuração. Quando iniciada, a apuração recebe o valor 1-Executando, e, ao ser concluída, é atualizada para 2-Finalizado.

Quando a apuração for concluída, caso o usuário possua inscrição no Event Viewer, será enviada uma notificação informando o término do processo.

3.3 Sped Fiscal

A rotina do Sped Fiscal foi alterada para gerar o registro 1400 conforme a apuração do IPM feita pelo Configurador de Tributos caso exista apuração para o período processado do Sped Fiscal.

Se para o período processado do Sped Fiscal não exista uma apuração de IPM pelo configurador de tributos, o registro 1400 será gerado da forma antiga, através da informação contida no campo Agr. Vlr. Mun. da TES.

04. Relatório

Foi desenvolvida no SmartView uma visão de dados que apresenta, de forma detalhada, as informações utilizadas na apuração.

05. Dicionário de Dados

- Necessário aplicar o UpdDistr para criar os seguintes metadados:

SIX

| INDICE | ORDEM | CHAVE | DESCRICAO |

| CKI | 1 | CKI_FILIAL+CKI_IDDETA+CKI_IDUNIQ | ID Det. Apur + ID Único |

| CKH | 1 | CKH_FILIAL+CKH_IDAPUR+CKH_UF+CKH_DIPAM+CKH_CODMUN | ID Apuracao + UF + Cod. Dipam + Cod. Municip |

| CKG | 2 | CKG_FILIAL+DTOS(CKG_DTINI)+DTOS(CKG_DTFIM) | Data Inicial + Data Final |

| CKG | 1 | CKG_FILIAL+CKG_ID | ID |

| CKF | 1 | CKF_FILIAL+CKF_IDIPM+CKF_UF+CKF_CODIPM+CKF_CODMUN | ID + UF + IPM + Município |

| CKE | 1 | CKE_FILIAL+CKE_ID+CKE_UF+CKE_CODIPM+CKE_REGCAL | ID + UF + IPM + Código Regra |

| CKD | 2 | CKD_FILIAL+CKD_CODREG | Código |

| CKD | 1 | CKD_FILIAL+CKD_ID+CKD_CODREG | ID + Código |

SX2

| X2_CHAVE | X2_ARQUIVO | X2_NOME | X2_UNICO | X2_MODO | X2_MODOUN | X2_MODOEMP | X2_SYSOBJ |

| CKI | CKIT10 | Apuração de IPM - Relatório | CKI_FILIAL+CKI_IDDETA+CKI_IDUNIQ | E | E | E | |

| CKH | CKHT10 | Apuração de IPM - Detalhamento | CKH_FILIAL+CKH_IDAPUR+CKH_UF+CKH_DIPAM+CKH_CODMUN | E | E | E | FISA325 |

| CKG | CKGT10 | Apuração de IPM - Cabecalho | CKG_FILIAL+CKG_ID | E | E | E | FISA325 |

| CKF | CKFT10 | Regra de IPM - Rateio | CKF_FILIAL+CKF_IDIPM+CKF_UF+CKF_CODIPM+CKF_CODMUN | E | E | E | FISA322 |

| CKE | CKET10 | Regra de IPM - Cadastro | CKE_FILIAL+CKE_ID+CKE_UF+CKE_CODIPM+CKE_REGCAL | E | E | E | FISA322 |

| CKD | CKDT10 | Cab. Regra de IPM | CKD_FILIAL+CKD_ID+CKD_CODREG | E | E | E | FISA322 |

SX3

| X3_ARQUIVO | X3_ORDEM | X3_CAMPO | X3_TIPO | X3_TAMANHO | X3_DECIMAL | X3_TITULO | X3_PICTURE | X3_F3 | X3_BROWSE | X3_VISUAL | X3_CONTEXT |

| CKI | 32 | CKI_CODFOR | C | 6 | 0 | Cod. Fornec. | @! | FOR | S | A | R |

| CKI | 31 | CKI_CODCLI | C | 6 | 0 | Cod. Cliente | @! | SA1 | S | A | R |

| CKI | 30 | CKI_FORNEC | C | 50 | 0 | Nome Fornec | @! | N | V | R | |

| CKI | 29 | CKI_CLIENT | C | 60 | 0 | Nome Cliente | @! | N | V | R | |

| CKI | 28 | CKI_VLTRIB | N | 14 | 2 | Vlr. Tributo | @E 99,999,999,999.99 | N | V | R | |

| CKI | 27 | CKI_ALIQ | N | 10 | 6 | Aliq Aplica | @E 999.999999 | N | V | R | |

| CKI | 26 | CKI_BSECAL | N | 14 | 2 | Base Calc | @E 99,999,999,999.99 | N | V | R | |

| CKI | 25 | CKI_VLTOT | N | 16 | 2 | Vlr. Total | @E 9,999,999,999,999.99 | S | V | R | |

| CKI | 24 | CKI_VLCONT | N | 14 | 2 | Vlr.Contabil | @E 99,999,999,999.99 | N | V | R | |

| CKI | 23 | CKI_MUNDES | C | 60 | 0 | Munic. Dest | @! | N | V | R | |

| CKI | 22 | CKI_UFDEST | C | 2 | 0 | UF Destino | @! | 12 | N | V | R |

| CKI | 21 | CKI_MUNORI | C | 60 | 0 | Munic Origem | @! | N | V | R | |

| CKI | 20 | CKI_UFORIG | C | 2 | 0 | UF de Origem | @! | 12 | N | V | R |

| CKI | 19 | CKI_MUNPAR | C | 60 | 0 | Munic Partic | @! | N | V | R | |

| CKI | 18 | CKI_UFPART | C | 2 | 0 | UF Partic | @! | 12 | N | V | R |

| CKI | 17 | CKI_LOJA | C | 2 | 0 | Loja | @! | N | V | R | |

| CKI | 16 | CKI_UFNOTA | C | 2 | 0 | UF Emi/Des | @! | 12 | N | V | R |

| CKI | 15 | CKI_DTEMIS | D | 8 | 0 | DT. Emissao | N | V | R | ||

| CKI | 14 | CKI_DTENT | D | 8 | 0 | DT.Ent. Doc | N | V | R | ||

| CKI | 13 | CKI_ITEM | C | 4 | 0 | Item | @! | N | V | R | |

| CKI | 12 | CKI_TPMOV | C | 1 | 0 | Tp.Movimento | @! | N | V | R | |

| CKI | 11 | CKI_SERIE | C | 3 | 0 | Serie | !!! | N | V | R | |

| CKI | 10 | CKI_NF | C | 9 | 0 | NF | @! | N | V | R | |

| CKI | 9 | CKI_CODTRI | C | 6 | 0 | Cod. Tributo | @! | N | A | R | |

| CKI | 8 | CKI_REGAPU | C | 6 | 0 | Reg/Proc Apu | @! | N | V | R | |

| CKI | 7 | CKI_CODMUN | C | 60 | 0 | Cod. Municip | @! | N | A | R | |

| CKI | 6 | CKI_FILDOC | C | 8 | 0 | Filial Doc | N | A | R | ||

| CKI | 5 | CKI_CODIPM | C | 60 | 0 | Cod. IPM | @! | N | V | R | |

| CKI | 4 | CKI_UFDOC | C | 2 | 0 | UF documento | @! | 12 | N | V | R |

| CKI | 3 | CKI_IDUNIQ | C | 36 | 0 | ID Único | @! | N | A | R | |

| CKI | 2 | CKI_IDDETA | C | 36 | 0 | ID Det. Apur | @! | N | V | R | |

| CKI | 1 | CKI_FILIAL | C | 8 | 0 | Filial | N | V | R | ||

| CKH | 9 | CKH_DSCDIP | C | 80 | 0 | Descr. Dipam | @! | N | V | V | |

| CKH | 8 | CKH_TIPO | C | 1 | 0 | Tipo | @! | N | V | R | |

| CKH | 7 | CKH_VLRADC | N | 14 | 2 | Vlr. Adic | @E 99,999,999,999.99 | N | V | R | |

| CKH | 6 | CKH_MUNICI | C | 60 | 0 | Município | @! | N | V | R | |

| CKH | 5 | CKH_CODMUN | C | 5 | 0 | Cod. Municip | @! | N | A | R | |

| CKH | 4 | CKH_DIPAM | C | 60 | 0 | Cod. Dipam | @! | N | V | R | |

| CKH | 3 | CKH_UF | C | 2 | 0 | UF | @! | N | V | R | |

| CKH | 2 | CKH_IDAPUR | C | 36 | 0 | ID Apuracao | @! | N | A | R | |

| CKH | 1 | CKH_FILIAL | C | 8 | 0 | Filial | N | V | R | ||

| CKG | 4 | CKG_DTFIM | D | 8 | 0 | Data Final | S | V | R | ||

| CKG | 3 | CKG_DTINI | D | 8 | 0 | Data Inicial | S | V | R | ||

| CKG | 2 | CKG_ID | C | 36 | 0 | ID | @! | N | V | R | |

| CKG | 1 | CKG_FILIAL | C | 8 | 0 | Filial | S | V | R | ||

| CKF | 7 | CKF_RATEIO | N | 5 | 2 | % Rateio | @E 99.99 | S | A | R | |

| CKF | 6 | CKF_DESCMU | C | 60 | 0 | Descrição | @! | S | V | R | |

| CKF | 5 | CKF_CODMUN | C | 5 | 0 | Município | @! | CC2CKF | S | A | R |

| CKF | 4 | CKF_CODIPM | C | 60 | 0 | IPM | @! | S | A | R | |

| CKF | 3 | CKF_UF | C | 2 | 0 | UF | @! | 12 | S | A | R |

| CKF | 2 | CKF_IDIPM | C | 36 | 0 | ID | @! | S | A | R | |

| CKF | 1 | CKF_FILIAL | C | 8 | 0 | Filial | S | A | R | ||

| CKE | 9 | CKE_IDF2B | C | 36 | 0 | ID Reg Calc | @! | N | A | R | |

| CKE | 8 | CKE_CONVLS | C | 1 | 0 | Vl Simbólico | @! | S | A | R | |

| CKE | 7 | CKE_CONSMU | C | 1 | 0 | Op.Município | @! | S | A | R | |

| CKE | 6 | CKE_REGCAL | C | 6 | 0 | Código Regra | @! | F2B3 | S | A | R |

| CKE | 5 | CKE_DSCIPM | C | 60 | 0 | Decrição | @! | S | V | R | |

| CKE | 4 | CKE_CODIPM | C | 60 | 0 | IPM | @! | CLNCKE | S | A | R |

| CKE | 3 | CKE_UF | C | 2 | 0 | UF | @! | 12 | S | A | R |

| CKE | 2 | CKE_ID | C | 36 | 0 | ID | @! | S | A | R | |

| CKE | 1 | CKE_FILIAL | C | 8 | 0 | Filial | S | V | R | ||

| CKD | 6 | CKD_VIGFIM | D | 8 | 0 | Data Final | S | A | R | ||

| CKD | 5 | CKD_VIGINI | D | 8 | 0 | Data Início | S | A | R | ||

| CKD | 4 | CKD_DESCR | C | 50 | 0 | Descrição | @! | S | A | R | |

| CKD | 3 | CKD_CODREG | C | 6 | 0 | Código | @! | S | A | R | |

| CKD | 2 | CKD_ID | C | 36 | 0 | ID | @! | N | V | R | |

| CKD | 1 | CKD_FILIAL | C | 8 | 0 | Filial | S | V | R |

SX7

| X7_CAMPO | X7_SEQUENC | X7_REGRA | X7_CDOMIN | X7_TIPO | X7_SEEK | X7_ALIAS | X7_ORDEM | X7_CHAVE | X7_PROPRI |

| CKF_CODMUN | 1 | Fisa322CC2(FwFldGet("CKE_UF"),FwFldGet("CKF_CODMUN")) | CKF_DESCMU | X | N | 0 | S | ||

| CKE_REGCAL | 1 | F2B->F2B_ID | CKE_IDF2B | P | N | 0 | S | ||

| CKE_CODIPM | 1 | SUBSTR(CLN->CLN_DSCIPM,1,60) | CKE_DSCIPM | P | S | CLN | 1 | XFILIAL("CLN")+FwFldGet("CKE_UF")+FwFldGet("CKE_CODIPM") | S |

SX9

| X9_DOM | X9_IDENT | X9_CDOM | X9_EXPDOM | X9_EXPCDOM | X9_PROPRI | X9_LIGDOM | X9_LIGCDOM | X9_CONDSQL | X9_USEFIL | X9_ENABLE | X9_VINFIL | X9_CHVFOR |

| SX5 | 8 | CKE | X5_TABELA+X5_CHAVE | '12'+CKE_UF | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 7 | CKI | X5_TABELA+X5_CHAVE | '12'+CKI_UFDEST | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 6 | CKI | X5_TABELA+X5_CHAVE | '12'+CKI_UFORIG | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 5 | CKI | X5_TABELA+X5_CHAVE | '12'+CKI_UFPART | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 4 | CKI | X5_TABELA+X5_CHAVE | '12'+CKI_UFNOTA | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 3 | CKI | X5_TABELA+X5_CHAVE | '12'+CKI_UFDOC | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 2 | CKH | X5_TABELA+X5_CHAVE | '12'+CKH_UF | S | 1 | N | S | S | 2 | 2 | |

| SX5 | 1 | CKF | X5_TABELA+X5_CHAVE | '12'+CKF_UF | S | 1 | N | S | S | 2 | 2 | |

| SA2 | 1 | CKI | A2_COD+A2_LOJA | CKI_CODFOR+CKI_LOJA | S | 1 | N | S | S | 2 | 2 | |

| SA1 | 1 | CKI | A1_COD+A1_LOJA | CKI_CODCLI+CKI_LOJA | S | 1 | N | S | S | 2 | 2 | |

| F2B | 1 | CKE | F2B_REGRA | CKE_REGCAL | S | 1 | N | S | S | 2 | 2 | |

| CLN | 1 | CKE | CLN_UF+CLN_CODIPM | CKE_UF+CKE_CODIPM | S | 1 | N | S | S | 2 | 2 | |

| CKG | 1 | CKH | CKG_ID | CKH_IDAPUR | S | 1 | N | S | S | 1 | 1 | |

| CKE | 1 | CKF | CKE_ID+CKE_UF+CKE_CODIPM | CKF_IDIPM+CKF_UF+CKF_CODIPM | S | 1 | N | S | S | 1 | 1 | |

| CKD | 1 | CKE | CKD_ID | CKE_ID | S | 1 | N | S | S | 1 | 1 | |

| CC2 | 2 | CKH | CC2_CODMUN | CKH_CODMUN | S | 1 | N | S | S | 2 | 2 | |

| CC2 | 1 | CKF | CC2_CODMUN | CKF_CODMUN | S | 1 | N | S | S | 2 | 2 |

SXB

| XB_ALIAS | XB_TIPO | XB_SEQ | XB_COLUNA | XB_DESCRI | XB_DESCSPA | XB_DESCENG | XB_CONTEM |

| CLNCKE | 6 | 1 | CLN->CLN_UF==FwFldGet("CKE_UF") | ||||

| CLNCKE | 5 | 1 | CLN_CODIPM | ||||

| CLNCKE | 4 | 1 | 4 | Descrição | Descripción | Description | CLN_DSCIPM |

| CLNCKE | 4 | 1 | 3 | Código IPM | Código IPM | IPM Code | CLN_CODIPM |

| CLNCKE | 4 | 1 | 2 | Dt Final | Fch. Final | End Date | CLN_DTFIMV |

| CLNCKE | 4 | 1 | 1 | Dt Início | Fch. Inicial | Start Date | CLN_DTINIV |

| CLNCKE | 2 | 1 | 1 | Filial+estado+codigo | Suc+E/P/R+Código | Branch+State+Code | |

| CLNCKE | 1 | 1 | DB | Ind.Partic.Munic. | Ind.Partic.Munic. | City Partic. Ind. | CLN |

| CC2CKF | 6 | 1 | CC2->CC2_EST==FwFldGet("CKE_UF") | ||||

| CC2CKF | 5 | 1 | CC2_CODMUN | ||||

| CC2CKF | 4 | 2 | 6 | Municipio | Municipio | City | CC2_MUN |

| CC2CKF | 4 | 2 | 5 | Cod. IBGE | Cód. IBGE | IBGE Code | CC2_CODMUN |

| CC2CKF | 4 | 2 | 4 | Estado | Est/Prov/Reg | State | CC2_EST |

| CC2CKF | 4 | 1 | 3 | Municipio | Municipio | City | CC2_MUN |

| CC2CKF | 4 | 1 | 2 | Cod. IBGE | Cód. IBGE | IBGE Code | CC2_CODMUN |

| CC2CKF | 4 | 1 | 1 | Estado | Est/Prov/Reg | State | CC2_EST |

| CC2CKF | 2 | 2 | 2 | Codigo Ibge | Código IBGE | IBGE Code | |

| CC2CKF | 2 | 1 | 1 | Municipio | Municipio | City | |

| CC2CKF | 1 | 1 | DB | Municipio Rateio | Municipio Prorrateo | Apportionment City | CC2 |

06. Demais Informações

Implementação cadastro Código IPM